Options can be written on underlying assets like real estate, commodities, stocks, or exchange-traded funds. Options can also be written on an index, which is a measureable value that is precisely defined and cannot be owned.

The Dow Jones Industrial Average (DJIA) is an index with components that are redefined over time. Options on the DJIA depend on the exact sum of the market values of its current components. This is different from a fund that tries to imitate the DJIA by holding many of the stocks in the index. Such a fund would have performance that is similar to, but not the same as, the DJIA index.

Index options are written on other economic variables, which cannot be directly owned like currency exchange rates. Since there is no underlying asset, most currency options are converted into their cash value when they expire or are exercised.

Data Regarding Index Options

Like options on commodities such as gold, an index option has four predetermined specifications:

-

The underlying asset: In this case, the asset is an index. Unlike gold, an index is not physical and cannot actually be owned.

-

The Type of Option: Call or put.

-

The Strike Price: A set amount of money for each option, which is to be paid if the option is exercised.

-

The Expiration Date.

The Underlying Asset and the Strike Price for an Index Option – a Preliminary Discussion

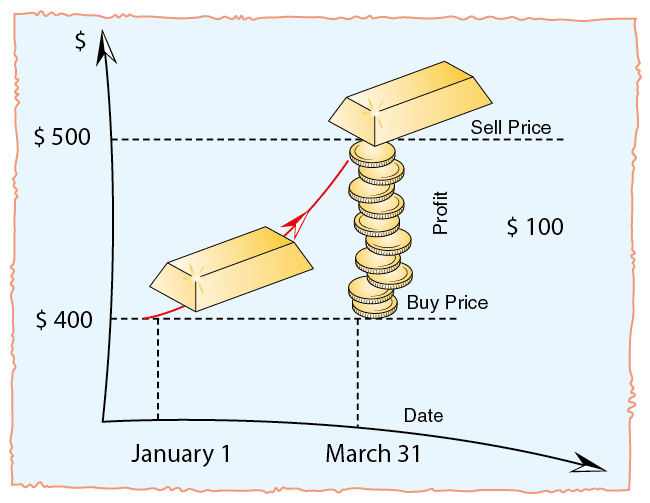

In the example of the gold option:

-

The price of the underlying asset is the market price of an ounce of gold on the expiry date.

The strike price is the price specified in the option terms.

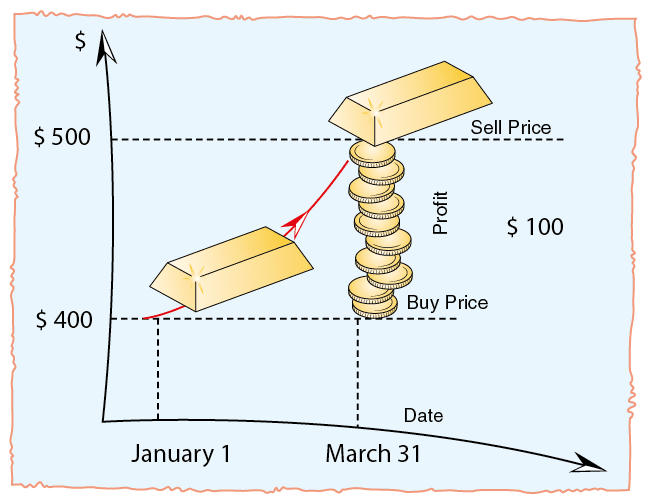

In the case of index options, it is difficult to understand what the underlying asset is. Nevertheless, it is easy to calculate its value.

Each index has its own underlying asset. The underlying asset for the DJIA is the DJX, which is calculated by dividing the DJIA by 100. Options are traded in units of 100. This means that if an order is placed with a broker to purchase one C 105 Janat a time when the current price is $7 (an option price is often called a premium), then the actual price paid is $700 because the broker will purchase an option on 100 DJX index units.

Specifications Appearing in Short Name of a DJX Option

Options symbols are named based on their attributes:

Root Symbol for Underlying Asset + Expiration Date (yymmdd) + Call/Put (C or P) + Exercise Price (to the tenth of a cent with a total of eight digits).

Consider a Google (ticker: GOOG) put with an exercise price of $500, which expires on April 16, 2010. Its attributes are below.

-

Root Symbol for Underlying Asset: GOOG

-

Expiration Date (yymmdd): 100416

-

Call/Put (C or P): P

-

Exercise Price: 00500000

The resulting symbol for this option would be GOOG100416P00500000.

The Strike Price

The strike price is always a fixed known value. The number under the title strike priceis an index number that is used to calculate the strike price. In this example, as explained above, the strike price actually paid is multiplied by 100 because each option is for 100 index units, and therefore the actual price paid for exercising the option is: $ 110 X 100 = $ 11,000

The Expiration Date

The expiration date differs according to the various options. Some options have a predetermined expiration date, while others have a random expiration date. In any case, the expiration date for options with a predetermined expiration date is sufficiently indicated by the expiration month. The specific expiration date is usually defined in the terms of the option and the specified month therefore automatically determines the exact expiration date.

Trading in Index Options Explained

The public can observe the course of trading via the internet. Data published on public websites appear, but only following a 15-20 minutes delay and not in real time. The following table explains all the information displayed on the options screen on the Yahoo! Finance Website.

|

Column |

Title |

Explanation |

Data in the Above Example |

|

1 |

Strike |

The list of strike prices traded |

P 113 APR |

|

2 |

Symbol |

The symbol (ticker) of the specific option |

DJVJPLX |

|

3 |

Last |

The price at which the most |

1.25 |

|

4 |

Chg |

The change in the option price |

0.05 |

|

5 |

Bid |

The purchase price of the option |

1.25 |

|

6 |

Ask |

The price at which the option is offered for sale |

1.35 |

|

7 |

Vol |

The number of shares that changed |

87 |

|

8 |

Open Int. |

The value of positions upon the specific option |

2.25

|