The preceding examples illustrated how large profits (and losses) can be earned by using options. There are many different investment strategies involving options that will not be discussed here. The following simple strategy uses put options as a hedge against falling stock prices.

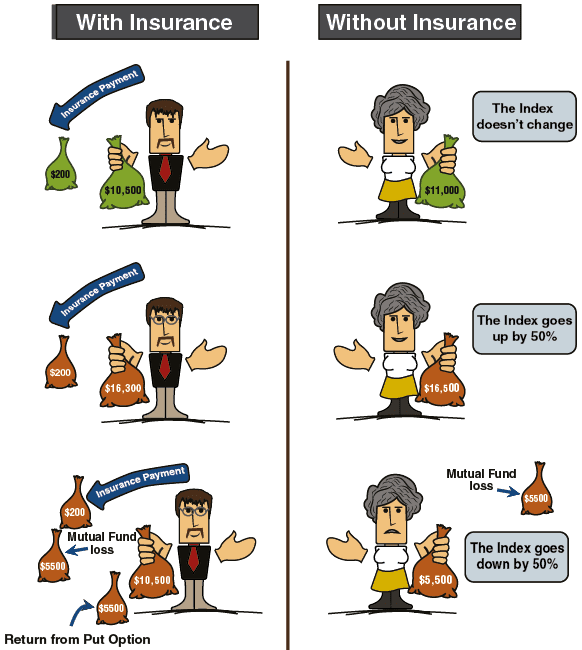

Assume that a shareholder invests in a mutual fund with a portfolio matching the DJX index. Assume futher that the DJX index is currently at 110, and that the investor has invested $11,000 into the fund.

Assume that the investor believes that the index will change drastically (i.e., that it will either rise or fall by 50%). Such an extreme situation could occur on the eve of a war, for example. The investor then has three alternatives:

-

Sell his shares and deposit the proceeds into a bank.

-

Do nothing, and hope that the index rises.

-

Buy 110 put options at $2 (reminder: since the option refers to 100 index units, the actual price is $200).

Calculation

Profit/loss according to the three alternatives:

-

Selling

-

Doing nothing

-

Buying a put option for $500.

Row three in the following table shows the profit gained by buying the options in every possible scenerio:

-

If the index does not change, then the cost of the options – $200 -is lost.

-

If the index rises by the least 50%, then the investor gains $5,300 ($5,500 profit on the mutual fund, minus the $200 cost of the option). Obviously, the investor will not exercised the options.

-

If the index falls 50%, then the investor loses $5,500 on his investment in the mutual fund, but recoups a $5,500 profit by exercising his option as shown by the following calculation:

($110-$55) x 100 = $5,500

The investor loses only the $200 cost of the options.

Comparing alternatives 1 and 3

If the index rises, Alternative 3 is the best by far. The investor loses in the other situations, but his losses are small.

Comparing alternatives 2 and 3

If the index falls, it is far better to invest in the options. In the other situations, the second alternative is better, but only slightly so.

Summary

Buying options in this situation hedges an investment portfolio in the same way that car insurance protects a car. Gains on the options compensate for a decline in share prices, just as an insurance payment compensates for a damaged car. This service is not free. As with insurance, a premium must be paid. In this case, the premium is the cost of the option.

|

Chosen option |

DJ index +50% |

DJ index -50% |

DJ index without change |

|

Sell |

$0 |

$0 |

$0 |

|

Do nothing |

$5500 |

$-5500 |

$0 |

|

Buy |

$5300 |

$-200 |

$-200 |

|

Exercise price |

$110 |

|

The DJX level on the exercise date |

$55 |

|

The difference |

$55 |

|

The difference multiplied by 100 indices |

$5500 |