When a company is founded, the founders can issue (distribute) stocks via the stock market. As mentioned previously, a stock certificate indicates ownership. The founders decide how much of the company each of them will own.

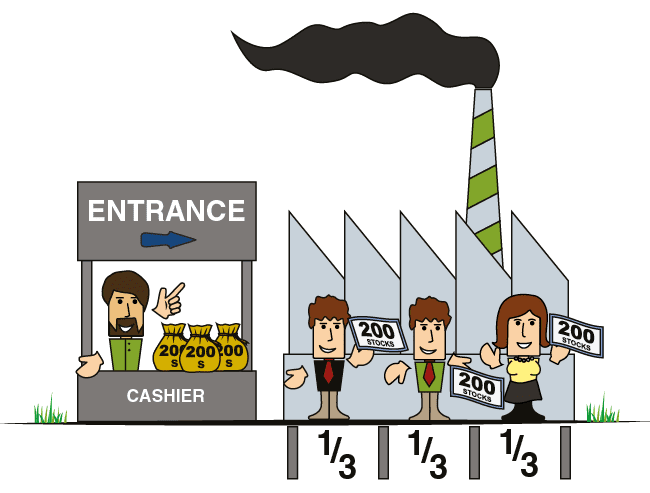

To begin with, let’s assume that three entrepreneurs – Allen, Benny, and John – have decided to start a new computer firm called “A – B Computers”.

The initial investment required is $600 (this is only an example; it could be $6,000, or $6 million). The three entrepreneurs decide that each will contribute $200 – one third of the total – and that each will own one third of the company. They also decide to issue 600 shares.

In other words, each of them will receive one share for every dollar they invest. Each will therefore receive 200 shares. Allen owns 200 of the 600 total shares. Like Benny and John, he owns one third of the company. If Allen buys both Benny’s and John’s shares, he will own all of the company’s stock and become the company’s sole owner.

In this example, the company’s founders chose to issue 600 shares – one share per dollar invested. However, nothing prevents them from issuing 1,200 shares (one share per $0.50), or three shares (one share per $200 invested).

The number of shares issued is determined solely according to the founders’ judgment and convenience. Regardless of how many shares are issued, each of the investors will still own one third of the company.

The founders can decide not to invest equally in the company, and to distribute the shares disproportionately.

Allen might be an extraordinary computer programmer, while Benny has connections with a distributor. Perhaps John knows nothing about computers, but he has just won the lottery and has a great deal of money.

The entrepreneurs can decide to invest unequal amounts of money and to determine their relative shares of the company by a different criterion than the size of their investment.

The table illustrates two ways to issue stock in stock market: Option A, an issue of 1,200 shares, and Option B, an issue of three shares.

The table illustrates two ways to issue stock in stock market: Option A, an issue of 1,200 shares, and Option B, an issue of three shares.

According to the table, Allen invests only $100, but receives 50% of the company’s shares due to his expertise. Benny also invests $100, but receives only 30% of the company shares, because his contribution is less significant than Allen’s. John, on the other hand, invests the most money, $400, but receives the smallest share in the firm.

This arrangement is not necessarily bad for John. There is a good chance that Allen’s and Benny’s skills will enable the company to succeed and that John will earn a significant profit on his 20% holdings. For example, if the company makes $1,000 profit during its first year, John will receive 20% of that, i.e. $200. That is much more than he could have earned by depositing $400 in the bank.

|

1 The Founders |

2 Total Investment |

3 Each Founder’s Portion |

4 Stocks Received |

|

Allen |

$200 |

33.3% |

200 Shares |

|

Benny |

$200 |

33.3% |

200 Shares |

|

John |

$200 |

33.3% |

200 Shares |

|

Total |

$600 |

100% |

600 Shares |

Table 2.2: Two different ways for issuing stocks at “A-B Computers”

|

1 The Founders |

2 Total Investment of each Founder |

3 Each Founder’s Portion of the Company |

4 Stocks Received |

|

|

|

Option A |

Option B |

||

|

Allen |

$200 |

33.3% |

400 Shares |

1 Share |

|

Benny |

$200 |

33.3% |

400 Shares |

1 Share |

|

John |

$200 |

33.3% |

400 Shares |

1 Share |

|

Total |

$600 |

100% |

1,200 Shares |

3 Shares |

Table 2.3: Ownership distribution between the founders of “A-B Computers”

|

1 The Founders |

2 Total Investment of each Founder |

3 Each Founder’s Portion of the Company |

4 Stocks Received |

|

Allen |

$100 |

50% |

300 Shares |

|

Benny |

$100 |

30% |

180 Shares |

|

John |

$400 |

20% |

120 Shares |

|

Total |

$600 |

100% |

600 Shares |