Even big companies owned by billionaire tycoons still need to be backed up by “bank loans”, for tax purposes and for a more efficient cash flow.

When a firm avails bank loans or borrows money from a bank, the firm has to give or issue a bond to the bank. A bond is a document serves as proof of the firm’s commitment to pay back the loan at a set time, and at a predetermined interest rate. Interest is the money that the firm must pay for the use of the bank’s funds.

Example:

If Bank A loans firm X $100,000 on January 1, 2008 for one year at 5% annual interest, the firm gives the bank a bond stating that the firm will repay the $100,000 principal, plus $5,000 interest, by December 31, 2008.

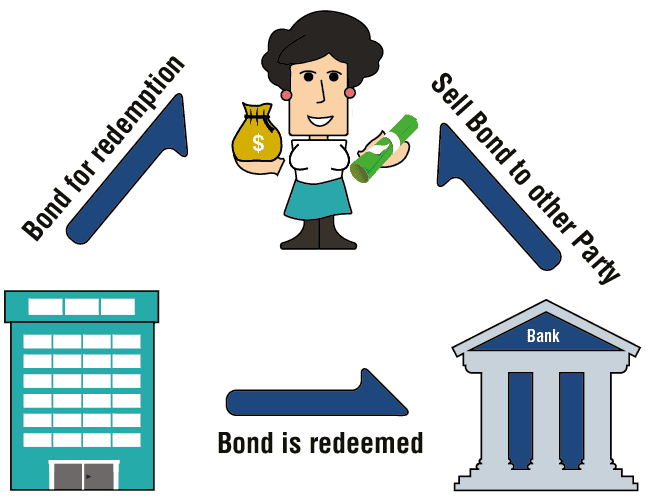

In other words, the bond is redeemed for $105,000 on December 31, 2008. At the end of 2008, the firm will have to pay $105,000 to anyone who presents their bond for redemption.

Another option is, if the bank wants to receive the payment or the money it has loaned, it can sell the bond to a third party, unless otherwise stipulated.

After the debt has been repaid, the firm receives the bond and nullifies it, so that it cannot be used to claim a different debt.