So What Are Different Types of Stocks?

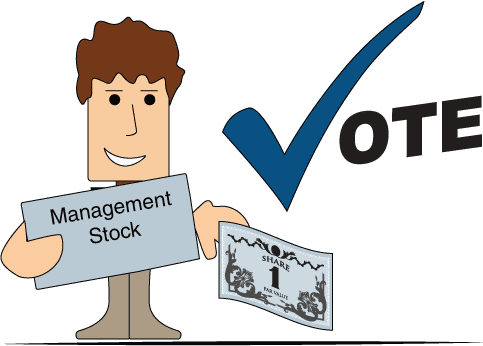

Most types of stocks that are traded in the capital market are common stocks. Management, founders, senior owners, and others often hold a different type of stock called management shares. This type of stock generally provides its owners special voting rights.

For example, a company may issue 1,000 shares of stock, conferring 51% of the company voting power to its management.

The main founders of a company usually hold management shares.

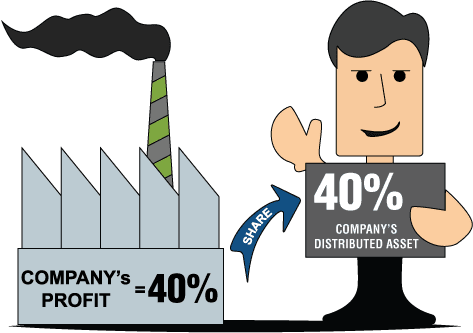

The Stockholders’ right to receive profits

Preferred stock shareholders are typically promised a fixed rate of return that is paid before dividends to common stock classes can be paid. Common stock shareholders rights’ involve the fraction of the value of company assets after preferred shareholders and creditors are paid in full.

Though the distinction between preferred shares and common shares is typical, investors should be aware that companies may customize the rights of different share classes. Investors should confirm the voting rights, priority, and other stipulations before buying shares in any share class.

The table shows how many units of present value each founder of “Baby Food” has.

Founder A received 100 shares of stock with a present value of $1, and 300 shares of $5 stock. The first group gives him a present value of $100, and the second gives him $1,500 more, making a total present value of $1,600.

The present value issued by the company totals $3,600. Founder A’s share is therefore 44.4% of stock, and he has the rights to 44.4% of the company’s profits:

![]()

Table 2.4: Calculating the PV of each founder, and his share of the “Baby Food” company’s profits:

| The Founders | Stocks received by each Founder of each class of share | PV received by each Founder of each class of stock and total PV | Portion of Company’s profit (pct.) | ||||

| PV 1 | PV 5 | PV 1 | PV 5 | Total | |||

| Founder A | 100 Shares | 300 Shares | 100 PV | 1,500 PV | 1,600 PV | 44.4% | |

| Founder B | 200 Shares | 200 Shares | 200 PV | 1,500 PV | 1,200 PV | 33.3% | |

| Founder C | 300 Shares | 100 Shares | 300 PV | 500 PV | 800 PV | 22.3% | |

| Total | 600 Shares | 600 Shares | 600 PV | 3,000 PV | 3,600 PV | 100% | |

The right to receive a liquidated company’s assets

When a company is dissolved or liquidated, different suppliers of capital are paid back in order of priority. Different classes of securities must wait until more senior securities are paid in full before being paid. Bondholders are typically given priority to preferred stock shareholders, who are in turn given priority to common stockholders. This priority also ranks different classes of bonds so that more senior bonds get paid before subordinated bonds get paid. Similarly, there is typically a ranking, which orders different stock classes.

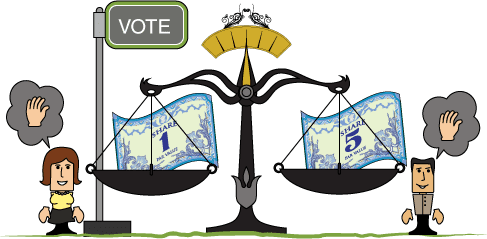

Voting rights

A share of stock gives the holder the right to vote on certain corporate issues. These votes are conducted like votes in Parliament or on a committee. In most cases, one share of stock confers one vote. However, each share of $5 also represents one vote, even though it is worth five regular $1 shares. The $5 stock is called inferior stock, because each voting right costs more than could be obtained by purchasing a $1 stock with the same voting rights.

The table shows the number of votes each investor has in “Baby Food”.

Founder A has 100 shares of $1 stock totaling 100 votes. He also has 300 shares of $5 stock, giving him another 300 votes.

He therefore has 400 of the 1,200 total votes.

Table 2.5: Calculating the voting power of each founder at “Baby Food”

| The Founders | Stocks received by each Founder of each class of share | PV received by each Founder of each class of stock and total PV | Portion of Company’s profit (pct.) | ||||

| PV 1 | PV 5 | PV 1 | PV 5 | Total | |||

| Founder A | 100 Shares | 300 Shares | 100 PV | 1,500 PV | 1,600 PV | 44.4% | |

| Founder B | 200 Shares | 200 Shares | 200 PV | 1,000 PV | 1,200 PV | 33.3% | |

| Founder C | 300 Shares | 100 Shares | 300 PV | 500 PV | 800 PV | 22.3% | |

| Total | 600 Shares | 600 Shares | 600 PV | 3,000 PV | 3,600 PV | 100% | |

Management Stock

The predominant type of non-common stock is management stock. These stocks usually represent significantly more voting power. The number of these shares issued is usually limited. Sometimes only one such share is issued; even though it might only be assigned a PV of $1, it may bestow a number of votes equal to the votes of all other outstanding shares.