Every mutual fund must publish a mutual fund prospectus before it begins to operate. This prospectus contains many important facts for investors considering purchasing the fund’s shares, including a list of the fund managers, their education and previous experience. It also describes the fund’s planned investment and profit sharing policies.

Specialized Funds

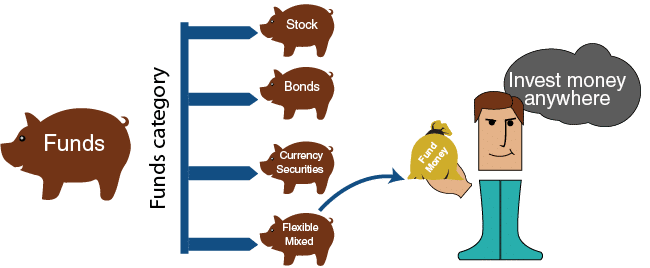

Every fund must declare which investments it plans to focus on. In Stock Market, funds are categorized according to their specializations and investment policies. If a fund specializes in stocks, for example, most of its investments will be that area. Other funds specialize in bonds, so their investments are in the bond market.

Other common specializations include foreign currency and foreign securities. There are also funds with a flexible or mixed investment policy, in which the manager is not obligated to concentrate on any specific investment sector – he invests the fund’s money at his own discretion.

The choice of which fund to join is based upon the investor’s assumptions regarding the future. Investors who think that the stock market will rise in the near future will join a fund specializing in stocks.

Mutual funds are alphabetized according to the companies operating them.

Click here to see the stocks listed on “The Wall Street Journal” website.