There is no proven method for picking a good stock. Stock prices are not like prices of bread and butter. They change minute by minute every single day depending only upon supply and demand.

When a company prospers and earns large profits, the demand for its stock usually rises, as does its stock price. If a company’s profits are shrinking, however, investors will want to sell their shares, and the stock price will fall.

In order to buy a stock successfully, which means that the stock price rises after the purchase, the best policy is to gather as much information as possible about the company, analyze it from many different angles, and test the relationship between the company and its stock price.

Knowing that a company is strong is insufficient. An assessment must be made as to whether its stock price is reasonable or inflated (too high). No company — no matter how good — is worth any price. Even gold has its price.

The opposite situation can also occur: A mediocre company’s stock can fall low enough to make it worth buying. Two tests for evaluating stocks are recognized by investors:

-

The ratio of price to earnings (P/E ratio).

- The ratio of market capitalization to the accounting, or book value, of shareholder’s equity is the P/B ratio.

Information needed for these ratios is available on most financial websites, the business sections of newspapers and in companies’ financial statements.

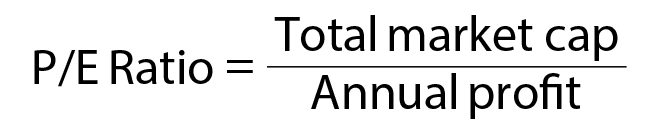

What is the P/E Ratio

The PE ratio measures how many years it takes an investor to make back his entire investment from a firm’s annual earnings. If $10 is invested in a stock, and the stock earns $1 per share every year, then the entire investment is recovered in 10 years.

This assumes that earnings per share remains constant at $1.

The PE Ratio of companies listed on the stock exchange can also be calculated by dividing the firm’s market cap (as calculated above) by its annual earnings.

The market cap is the total number of outstanding shares multiplied by the market price. Listed companies publish their earnings every quarter.

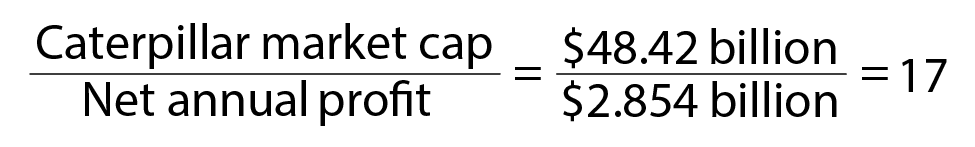

For example, the P/E ratio of “Caterpillar” on March 9, 2006 was 17.

An investor who buys “Caterpillar” for $48.42 billion will earn back his entire investment in 17 years, assuming that the annual profit remains steady at $2.854 billion per year.

As a rule, the lower the P/E ratio, the better the investment because investors recoup their investments sooner.

The P/E ratio depends upon two important factors: The quality of the company, as measured by its earnings, and its stock price, as measured by its market cap.

The P/E ratio also helps when comparing different companies in the same industry, such as real estate companies and communications industry companies. The company with the lower P/E ratio will usually be considered more attractive than a company with a higher P/E ratio.

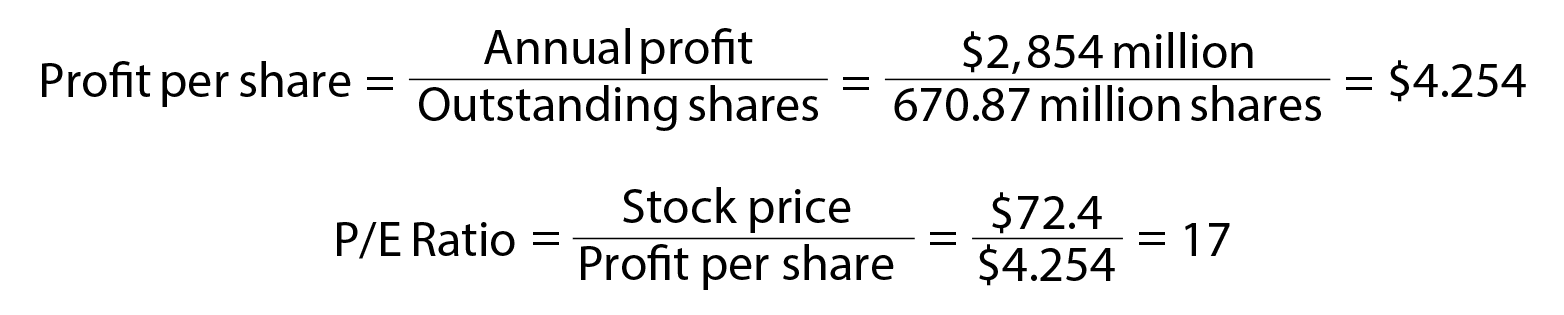

Another way of calculating the P/E ratio that is perhaps even more convenient is to divide the share price by the earnings per share. These figures are usually published in the business sections of various newspapers. First calculate the profit per share by dividing the annual profit by the number of outstanding shares:

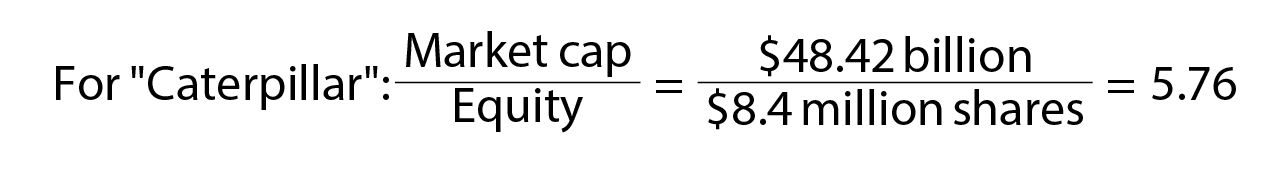

The ratio of market cap to shareholders’ equity

This ratio means that investors spend $48.42 billion for $8.4 billion in equity (net assets). In other words, they are willing to spend $5.76 for every $1 in net assets. Why are they willing to spend so much?

There are a number of possible reasons:

- The net assets of the company may be worth more because the value of the company’s assets, which is used for calculating its equity, is based on their purchase price. Just as a house can rise in value, a company’s assets can actually be worth more than the amount paid for them.

- A firm can produce significant profits from its assets due to the net value of its assets. The lower the ratio of market cap to equity, the lower the price that investors must pay for a portion of those assets.

Financial analysts have concluded that the P/E Ratio is more significant for industrial and commercial enterprises, while the market cap to equity ratio is more relevant for companies in the real estate industry.