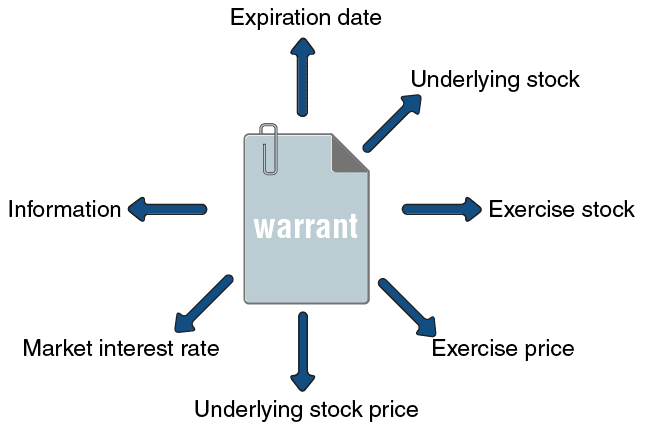

A number of important factors influence the price of a warrant. The firm that issues the warrant determines the first four factors, and market forces determine the others:

-

The expiration date is the date that determines the time frame for exercising the warrant. After this date, the warrant becomes worthless.

-

The underlying stock is the stock that a warrant holder receives when he exercises his warrant.

-

The exercise rate reflects the number of shares received when a warrant is exercised.

-

The exercise price is the price per share that a warrant holder pays when exercising his warrant.

-

The underlying stock price is the price of the underlying stock on the stock exchange.

-

The market interest rate is the interest rate affects many decisions by investors, including investments in warrants (this topic is not discussed in this volume).

-

Information about the underlying, including dividend payments and stock price volatility.

For example, if the exercise rate is 1, and a 3-for-2 stock split is declared, then the exercise rate automatically becomes 2.

Dividends distributed by a company have no effect on the exercise rate. Since dividends depress the stock price, the value of warrants also falls.

Here is an example of a warrant with all of the relevant information. The stock name is American Bio Medica (the stock’s ticker symbol is ABMC and the warrant’s ticker symbol is ABMCW).

Buying and Exercising a Warrant

The act of purchasing a warrant, exercising it, and receiving a stock for it is equivalent to buying the stock in two payments. The first payment is made when the warrant is purchased and the second payment is made when the warrant is exercised.