Understanding Different Types of Stock Indices.

The Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average (nickname: The Dow) is the oldest index in the capital market, and the most famous. This index includes the 30 largest companies in the American capital market. The weight of each company in the index corresponds to its stock price.

The editors of “The Wall Street Journal” choose which companies are included in the index and also decide when and how to modify the composition of the index. Approximately 20 changes have been made in the index to date. General Motors is the only company that has been included in the index since it was founded in 1896.

The S&P 500

The S&P 500 is composed of 500 stocks of large firms in the American capital market. While the Dow serves as an indicator for the “heaviest” companies in the market, the S&P reflects the entire American economy and capital market.

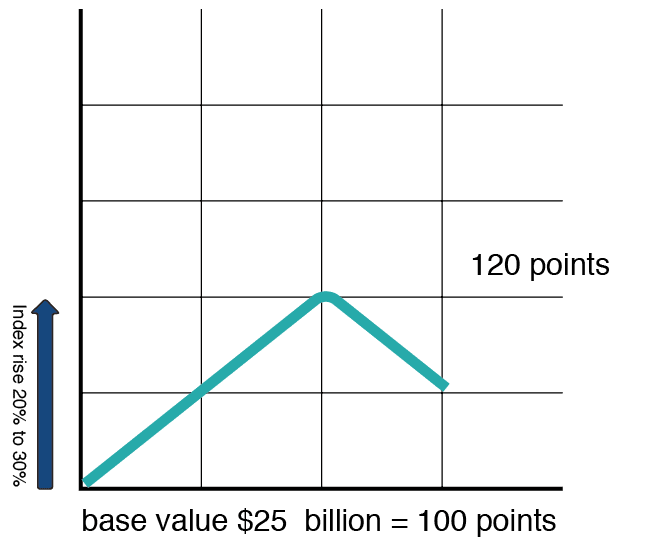

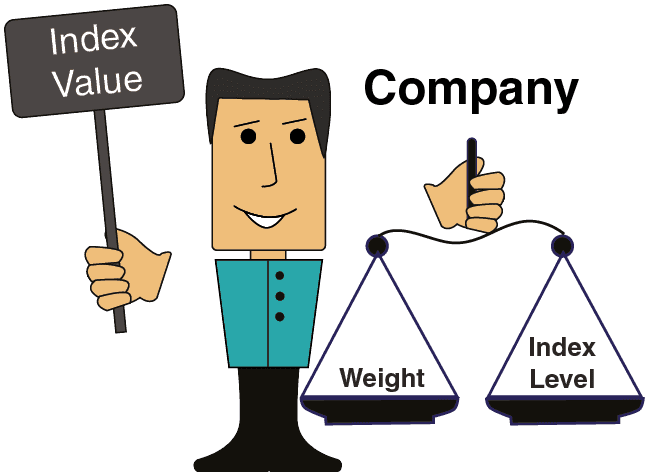

The S&P is based on both the stock price and market cap of each company. Assuming that the base index (i.e. the first index published) was 100 points (=100%), then subsequent indices increase or decrease according to the cumulative increase or decrease of the stocks included in the index. For example, if the base value of the index was $25 billion = 100 points, and the total value of the index rises by 20% to $30 billion, the index will be 120 points. The greater the weight of an individual company in the index, the more it influences the level of the index.

The NASDAQ Composite Index

The NASDAQ Composite Index includes all of the stocks listed on the NASDAQ exchange. Since most of the companies listed on that exchange are high-tech companies, the index is a good indicator for that sector of the American capital market.

The index is calculated according to the market cap of the companies. The base year is 1971.