Class:

All options of the same type that are written for the same asset are in the same class.

Series:

A series of options characterizes options with the same underlying asset and expiration date. For example, Series 1 options are DJX options that expire in March.

Level:

The level of an option is its strike price. Levels are determined according to a specific underlying asset

(i.e., level 110, level 120, etc.). Levels are ordered from bottom to top.

Management of Option Trades

Various stock exchanges manage option trades. Each option is listed on a specific stock exchange (and sometimes on more than one). The stock exchange determines the specifications of every option trades, including:

-

The duration of the options.

-

The number of series with the same underlying asset.

-

The commencement date and expiration date of each series.

-

The level of each series (i.e., the variety of strike prices available for each series).

Options Duration

DJX options have durations of 1, 2, 3, 6, 9, 15 and even 21 months. They begin on the Sunday following the third Friday of the month, and expire on the third Friday of the expiration month. For example, C 110 July options expire on the third Friday of July.

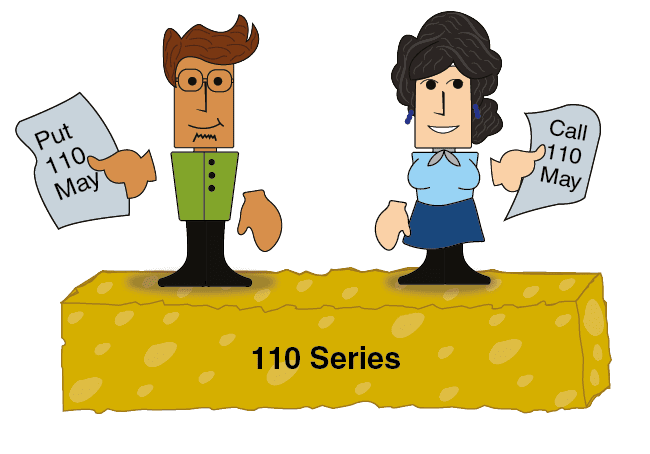

The Classes and Series of Options Trading

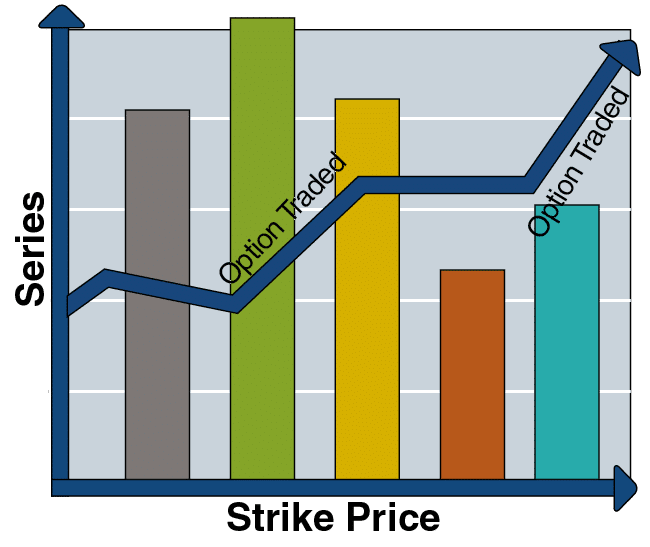

As mentioned earlier, options for different months are traded on various exchanges. There are a specific number of levels within each series. Options trading can be done only at these levels. When one series of options trading expires, trading begins in a new series of options. Trading always takes place in series with four different expiration dates.

Setting the Available Strike Price

Each month, one series of options expires and trading in a new series begins. The strike prices available for this new group of options are determined by the DJX index on the Friday of the expiration month. If the DJX was at 105 points at the end of trading that Friday, then an options series will be issued with a few prices above 105 and a few prices below 105.

Adding New Strike Prices

If the index level approaches the strike price of the highest level during the life of an option, then a new level with a higher strike price is introduced.

On the other hand, if the index falls and begins to approach the strike price of the lowest series, then a new series with a lower strike price is introduced.