Understanding 4 Most Common Practical Stock Market Terms:

Market capitalization (market cap)

In stock market, the amount of money that an investor would have to pay in order to buy all of the shares of a firm at the market price. A company’s market cap on a given date is the amount of money an investor would have to pay for the entire company according to its stock price on that date.

For example, the market cap of “Caterpillar” (ticker: CAT) on March 31, 2008 is calculated in the following table.

|

Total Number of Shares |

Price per Share (in $) (2) |

Market Cap (in millions of $) (1) x (2) = (3) |

|

668.85 |

$72.40 |

$48,424 |

Total Return

One of the 4 Stock Market Terms is Total Return. “Total Return” is the profit that an investor earns on a stock from an increase in stock price, dividends paid to the investor, or both. The total return from Google (ticker: GOOG) from December 30, 2005 to December 30, 2005 was 115.2%. This means that an investor who held Google during that period gained more than 100% on his original investment. Since Google did not pay dividends during this period, total return consisted entirley of increases in share price.

Profit is derived from two main sources:

- A rise in the stock price.

-

Dividends distributed to the company’s shareholders (this will be explained later)

Shareholders’ Equity (Net Assets)

Companies have both Assets and Liabilities.

A company’s assets consist mainly of:

Long term assets: real estate, office buildings, equipment, and other long-term assets.

Current Assets: Inventory, cash and cash equivalents, and debts owed to the company by customers who purchased the company’s products, but have not yet paid for them.

A Company’s Liabilities Consist Mainly of:

Long Term Debt: These are loans that the company owes to banks and other institutions for a period of more than one year.

Current Debt: Cash owed to various suppliers, short-term loans from banks, and payroll obligations.

Shareholders’ Equity

If a firm were to sell all of its assets and pay off all of its liabilities (both long-term and current debt), then the remaining money (if any) is called its “shareholder’s equity”.

If the money raised by selling off all of a company’s assets does not cover its debts, then the company has a net liability, called a “negative shareholder’s equity”.

Table 2.7: The Assets and Liabilities of “A-B Computers”

|

Assets |

Liabilities |

Equity |

|

Capital (permanent) assets: $100 |

Long term loans: $50 |

|

|

Current assets: $200 |

Current liabilities: $200 |

|

|

Total assets: $300 |

Total liabilities: $250 |

$300 – $250 = $50 |

Stock Splits

A stock split is sometimes considered a benefit distributed to the company’s shareholders, but

a stockholder does not actually receive any benefit from a stock split.

A stock split occurs when a company’s management declares that anyone owning the company’s stock will receive additional shares.

If shareholders receive one additional share for each share that they own, the stock split is 100%: 2 shares for 1 share (or, a 2-for-1 split). A company can also award a third share for every two shares already owned. This is a 50% stock split, or a 3-for-2 split. A stock split provides investors with more shares, but not more value. In a 2-for-1 split, the share price drops to about half of what it had been before the stock split.

Possible Reasons for a Stock Split:

-

In order to boost the trading volume of a high-priced stock.

-

In order to increase the number of a company’s outstanding shares prior to a public offer.

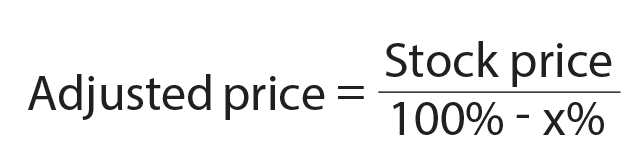

Following a stock split of X% (a [1+x]/100 for 1 stock split),

the adjusted price is calculated according to the following formula:

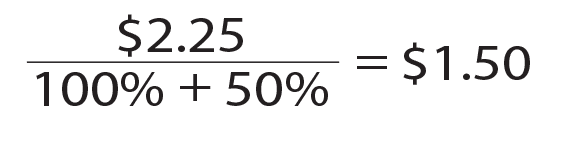

For example, if the original stock price is $2.25, following a 50% (3-for-2 stock split), then the stock price will fall to $1.50.

Navigate forward to learn about dividends.