Full Name: New York Stock Exchange.

Short Name: NYSE.

Location: New York City.

Established: 1792.

Number of Companies Listed, 2010: Approximately 3,200. The NYSE is the largest and most famous of the exchanges in the US.

Large, established firms, such as Coca-Cola and General Electric, are traded here.

Background

The New York Stock Exchange is located on the well-known Wall Street in downtown Manhattan. Trades are processed using an auction system that has not been significantly changed during the past 100 years. Trading in securities begins at 9:30 AM and ends at 4:00 PM.

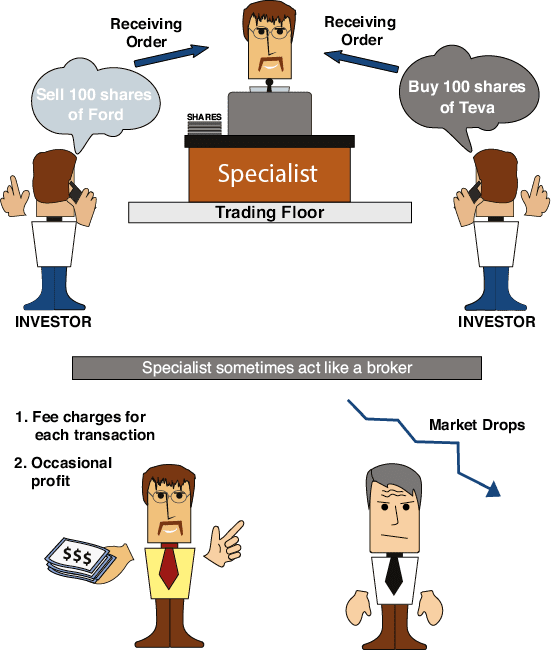

The trading system depends on various trading stand operators who are called specialists. Each specialist is the exclusive stock dealer for a number of different firms. He acts as a middleman between the various market traders. Market traders are therefore brokers for other brokers.

Trading in a given stock is conducted exclusively through the specialist for that stock and at his trading stand, which is located on the trading floor of the stock exchange. The only parties authorized to trade at the exchange itself are special traders who are members of the exchange (and usually associated with large brokerage firms).

The NYSE has approximately 1,300 members. This number remains constant and anyone wishing to trade at the exchange itself must buy a place from someone else.

Every order eventually reaches the office of an exchange member. From there it is sent to a runner on the trading floor. When the runner receives an order, then he brings it to the appropriate stand and gives it to the specialist.

The specialist then announces the order and allows the nearby brokers to bid for it. Whoever offers the best price completes the transaction. If the order is a limit order, then the specialist remains careful to stay within the stipulated limits when auctioning the stock.

If no suitable trading partner is found by this method, and if the only offer for the stock is much higher or lower than had been the case during the preceding transaction, then the specialist can prevent an extreme change in the stock price by acting as a private broker and buying or selling the stock himself.

The following are examples of the two types of orders:

Sell order

Sell order

the specialist receives an order to sell 100 shares of Ford. He declares the request, and waits for bids.

The stocks are sold to the highest bidder.

Buy order

The specialist receives an order to buy 100 shares of Ford. The shares will be purchased from the seller offering the lowest price.

If an order is for 1,000 or 10,000 shares, then the specialist splits it up into batches of 100 shares and auctions each batch separately.

Specialists make money from fees that they charge for each transaction and also from occasional profits on stocks that they trade themselves. When the market drops sharply specialists can lose huge amounts of money.

During the October 1987 crash, stocks plunged so steeply that there were no buyers at all in many cases, and specialists were forced to buy plummeting stocks with their own money.