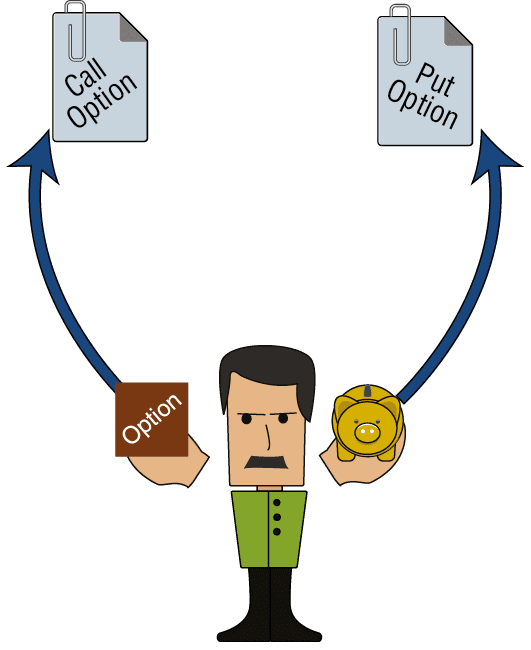

Every option is a contract that gives the owner of the stock options, power over the option writer.

A call option gives the call owner the power to force the call option writer to sell the underlying asset to him at the predetermined exercise price. If the exercise price is lower than the market price for the underlying asset, then the owner of the call can profit in two steps:

-

Exercise the stock options, forcing the call writer to sell the underlying asset to the call owner at the lower exercise price.

-

Reap a profit by quickly selling the underlying asset at the higher market price.

A put option gives the put owner the power to force the put writer to buy the underlying asset from him at the predetermined exercise price. If the exercise price is higher than the market price for the underlying asset, the owner of the put can profit in two steps:

-

Buy the underlying asset at the lower market price.

-

Reap a profit by quickly exercising the put, forcing the put writer to buy the underlying asset from him at the higher exercise price.

These transactions are carried out only if it is possible to buy low and sell high.

Obviously, the value of the transaction is determined by two factors: the value of the underlying asset and the strike price. In the case of gold options the underlying asset is something material. Its price, and the strike price, are both easily understood.