Most options’ trading is computerized and continuous.

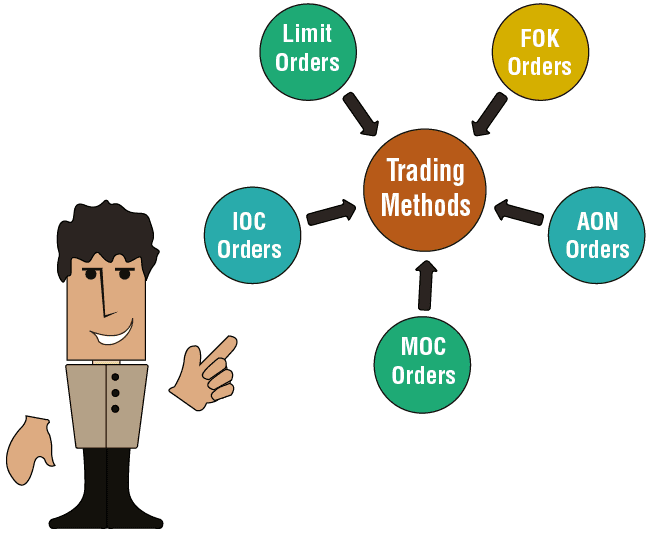

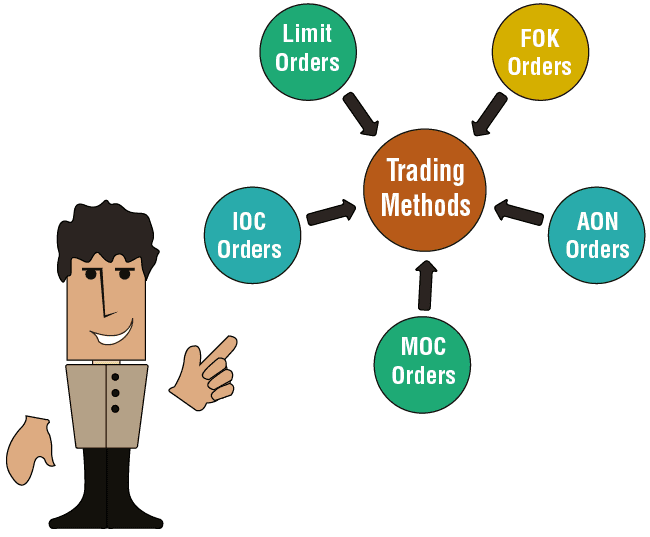

Types of orders:

-

Limit orders – these orders work like stock orders.

-

Fill or kill (FOK) orders – these orders must fulfill two criteria. The transaction must occur immediately, and the order must be completely filled. If the transaction does not take place within a few seconds, the order is canceled.

-

Immediate or Cancel (IOC)– In this particular stock market trading method, the first condition (i.e., the transaction occurring immediately) is sufficient for this order. Any part of the order that can be filled within just a few seconds of the placement of the order is carried out, and the remainder of the order is canceled.

-

All or None (AON) – this is an order that is executed only if it is filled completely. The difference with a FOK is that it doesn’t get canceled immediately and can be used together with a day order.

-

Market-on-close (MOC)– this is an order that is filled near the closing time of the market. This is useful for traders who want to exercise at the last moment of the expiration day.