Options investment has developed tremendously in markets throughout the world.

The extent of options trading even rivals that of stock investments.

Trading in options allows investors to diversify and to enrich their investment portfolios.

Example:

The variety of option strategies enables investors to customize positions to profit from different scenarios. Some option positions gain from market declines. Others are hypersensitive to market moves, and increase in value as much as 50% for a 10% market gain. Some option positions can be constructed to profit from stagnant markets.

An investor can utilize a large and complicated system of strategies in assembling a portfolio. Each investor uses these strategies to maximize profits from correct guesses and minimize losses from incorrect ones. There are both simple strategies and complicated ones. Success is achieved by correctly predicting the stock market, and by adopting an appropriate strategy. As stated above, this course focuses only on the concept of options. Investment strategies won’t be discussed.

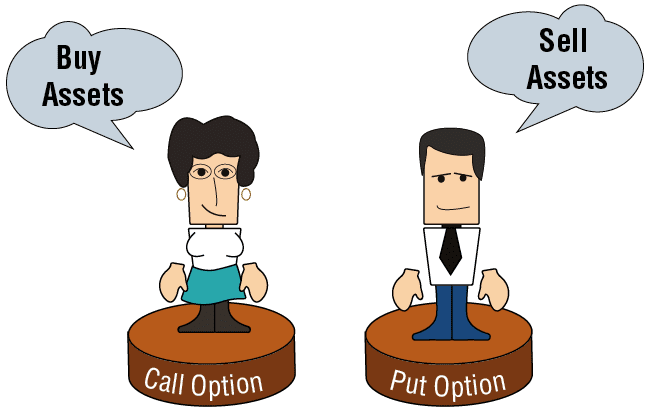

What is an OptionCall option

a security that grants its holder the right to buy a certain asset that is referred to as the underlying asset under the predetermined terms that are listed on the option. The option holder is not obligated to exercise his right.

A Purchase (Call Option)

The letter that David received from his father is essentially a call option: to purchase an ounce of gold. David will exercise the call option only if it is in his interest to do so.

Put option

a security that grants its holder the right to sell a certain asset (also referred to as the underlying asset) under the predetermined terms listed on the option. The option holder is not obligated to exercise his right.

A Sell (Put Option)

David also received a birthday present from his mother: A letter promising to buy one ounce of gold for $400 from whomever was in possession of the letter on March 31.

This letter essentially represents a put option, i.e., an option to sell. David will exercise his option only if it is worthwhile.

If the price of gold falls to $350 an ounce on March 31, then David will instead buy an ounce on the market for $350 and sell it to his mother for $400, while earning a $50 profit.