| Market dATA | |

| DJ Index | 100 points |

| Prices | |

| Call 100 | $1,000 |

| Put 100 | $1,500 |

Strategy name:

Short “Straddle”.

Recommended use of strategy

Expectation of steady DJ Index

Strategy components

Writing a Short Call and writing a Short Put at an identical strike price (The strike price of the Call option and the Put option should preferably be close to the current DJ Index).

Example: Write Short Call 100 at a price of $1,000 and write a Short Put at a price of $1,500.

Expenses / income from building the strategy

Income of $2,500.

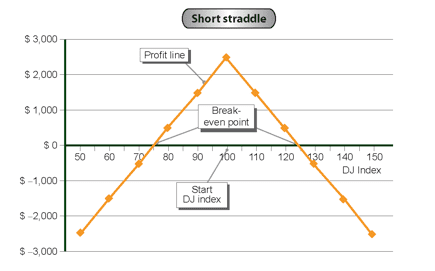

Strategy graph:

Auxiliary table for building the profit line

| DJ Index (Horizontal axis) |

(Fixed expenses)/ fixed income | Variable income (Call contribution) |

Variable income (Putl contribution) |

Total profit / (loss) (Vertical axis) 2+3+4 |

| 1 | 2 | 3 | 4 | 5 |

| 50 | $2,500 | — | ($5,000) | ($2,500) |

| 60 | $2,500 | — | ($4,000) | ($1,500) |

| 70 | $2,500 | — | ($3,000) | ($500) |

| 80 | $2,500 | — | ($2,000) | $500 |

| 90 | $2,500 | — | ($1,000) | $1,500 |

| 100 | $2,500 | — | — | $2,500 |

| 110 | $2,500 | ($1,000) | — | $1,500 |

| 120 | $2,500 | ($2,000) | — | $500 |

| 130 | $2,500 | ($3,000) | — | ($500) |

| 140 | $2,500 | ($4,000) | — | ($1,500) |

| 150 | $2,500 | ($5,000) | — | ($2,500) |

Strategy analysis:

Source of loss

We lose on a change in the index:

- When the index goes up we lose on the Short Call we have written.

- When the index goes down we lose on the Short Put option we have written.

Source of profit

Income from building the strategy. The profit is at a maximum if the DJ Index remains steady. The profit is limited to no more than the amount received for writing the options.

Break-even point

When the loss from the Call option or from the Put option equals the income from writing the options totaling $2,500. This occurs when the index is at 125 points or 75 points.