| Market Data | |

| DJ Index | 100 points |

| Prices | |

| Call 100 | $1,000 |

Strategy name:

Long Call option.

Recommended use of strategy

Expectation of increase in DJ Index.

Strategy components

Purchasing a Call option.

Example: Purchasing Call 100 at a price of $1,000

Expenses / Income from building the strategy (at start date)

Expenditure of $1,000.

Note: In the examples in this book, we use “convenient numbers” such as DJ Index 100 and option price of $1,000. This is in order to simplify the discussion. In reality, the numbers are of course different.

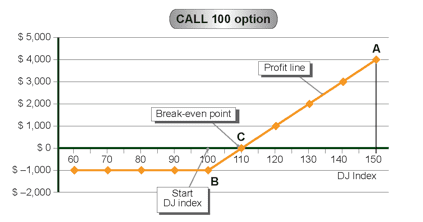

Strategy graph:

In this example, if the DJ Index is at 150 points (point A), the profit will be $4,000.

If the index is at 100 (point B) the loss will be $1,000 and if the index is at, 110 (point C), the profit will be $0, this being the break-even point.

As previously mentioned, when we are in the loss area, the profit line is under the “0” line. When we are in the profit area, the profit line is above the “0” line.

As you can see, the profits from buying a Call option are unlimited, while the loss is limited to $1,000 (the cost of the option).

When the DJ Index is below 100 points, the purchaser will not exercise the option.

Caution:

Despite the “limited loss” (in this case $1,000), this represents the whole of the amount invested.

Auxiliary table for building the profit line

| DJ Index (Horizontal axis) |

(Fixed expense)/ fixed income |

Variable expenses | Variable income (Call contribution) |

Total profit/ (loss) (Vertical axis ) 2+3+4 |

| 1 | 2 | 3 | 4 | 5 |

| 80 | ($1,000) | —– | —– | ($1,000) |

| 90 | ($1,000) | —– | —– | ($1,000) |

| 100 (B) | ($1,000) | —– | —– | ($1,000) |

| 110 (C) Breakeven point | ($1,000) | —– | $1,000 | $0 |

| 120 | ($1,000) | —– | $2,000 | $1,000 |

| 130 | ($1,000) | —– | $3,000 | $2,000 |

| 140 | ($1,000) | —– | $4,000 | $3,000 |

| 150 (A) | ($1,000) | —– | $5,000 | $4,000 |

Explanation of table:

Column 1 – The DJ Index in 10-point intervals

Column 2 – There is a fixed expense of $1,000 resulting from the purchase of the option. (The figure in brackets denotes an expense)

Column 3 – There are no variable expenses for this strategy.

Column 4 – This income results from exercising the option. For example, when the

index is 130, the profit from the option is $3,000, according to the

following calculation: $13,000 (DJ Index X $100)

$10,000 (Strike price X $100)

Profit: $3,000

Column 5 – Obtained by totaling columns 2+3+4

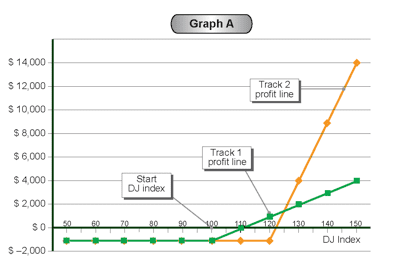

Addendum

In the above example we purchased a Call 100 option, at a price of $1,000 (Track 1).

We are able to purchase a Call 120 option at a price of only $200. For $1,000 we are able to purchase 5 Call 120 options (Track 2).

Graph A shows the profit lines for the two tracks. In Track 2 the “success” limits are reduced. The “success” commences at an index of 122 points, instead of 110 points for Track 1, but the amount of the profit above 125 points is higher than for Track 1.

In each of the following strategies, we will present only one track, but there are additional alternate tracks which can be used to reduce or extend the success limits and thus increase or decrease the profit accordingly.