| Market dATA | |

| DJ Index | 100 points |

| Prices | |

| Call 100 | $1,000 |

| Put 100 | $600 |

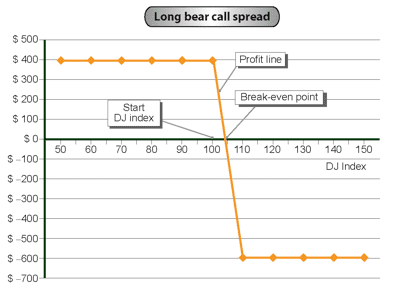

Strategy name:

Long “Bear Call Spread” (Declining Market Spread).

Recommended use of strategy

Expectation of moderate decrease in the index, with a limited loss if we are mistaken and the index goes up.

Strategy components

Writing a call option of a certain strike price.

Buying a call option of a higher strike price.

For example, writing a Call 100 option for $1,000 and buying a Call 110 option for $600.

Expenses / Income from building the strategy

Income of $400.

Strategy graph:

Auxiliary table for building the profit line

|

DJ Index (Horizontal axis) |

(Fixed expense) / fixed income |

Variable expenses (Call 100) |

Variable income (Call 110) |

Total profit / (loss) (Vertical axis) 2+3+4 |

|

|

|

|

|

|

|

50 |

$400 |

– |

– |

$400 |

|

60 |

$400 |

– |

– |

$400 |

|

70 |

$400 |

– |

– |

$400 |

|

80 |

$400 |

– |

– |

$400 |

|

90 |

$400 |

– |

– |

$400 |

|

100 |

$400 |

– |

– |

$400 |

|

110 |

$400 |

($1,000) |

– |

($600) |

|

120 |

$400 |

($2,000) |

$1,000 |

($600) |

|

130 |

$400 |

($3,000) |

$2,000 |

($600) |

|

140 |

$400 |

($4,000) |

$3,000 |

($600) |

|

150 |

$400 |

($5,000) |

$4,000 |

($600) |

Strategy analysis:

Source of Loss

When the index goes up we lose on the Call 100 option which we wrote. But when the index goes over 110, the additional loss is offset by the Call 110 we bought.

Source of profit

The Profit derives from building the strategy, on which we profited $400, and does not increase.

Break-even point

When the loss on the Call 100 option equals the profit from the strategy – $400.

This occurs when the index is at 104 points.