| Market dATA | |

| DJ Index | 100 points |

| Prices | |

| Call 100 | $1,000 |

| Put 100 | $1,000 |

Strategy name:

Long “Strip”.

Recommended use of strategy

Expectation of volatile index but with a greater change of a decrease. Returning to the example of the elections, we forecast a higher probability of Y being expected President — driving down the index.

Strategy components

Buying 2 Put options of identical strike price.

Buying one Call option with the same strike price.

For example: Buying 2 Put 100 options and one Call 100 option.

Expenses / Income from building the strategy

Expenditure of $3,000

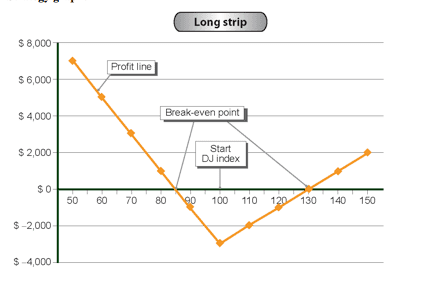

Strategy graph:

Auxiliary table for building the profit line

| DJ Index (Horizontal axis) |

(Fixed expenses)/ fixed income | Variable income (Call contribution) |

Variable income (Putl contribution) |

Total profit / (loss) (Vertical axis) 2+3+4 |

| 1 | 2 | 3 | 4 | 5 |

| 50 | ($3,000) | — | $10,000 | $7,000 |

| 60 | ($3,000) | — | $8,000 | $5,000 |

| 70 | ($3,000) | — | $6,000 | $3,000 |

| 80 | ($3,000) | — | $4,000 | $1,000 |

| 90 | ($3,000) | — | $4,000 | ($1,000) |

| 100 | ($3,000) | — | — | ($3,000) |

| 110 | ($3,000) | $1,000 | — | ($2,000) |

| 120 | ($3,000) | $2,000 | — | ($1,000) |

| 130 | ($3,000) | $3,000 | — | $0 |

| 140 | ($3,000) | $4,000 | — | $1,000 |

| 150 | ($3,000) | $5,000 | — | $2,000 |

Strategy analysis:

The strategy analysis is similar to that of the Long “Straddle”.

Source of Profit

We profit when there is a change in the index.

When the index goes up, we profit on the call option.

When the index goes down we profit on the 2 Put options.

The profit is greater if the index falls.

Source of loss

The loss derives from buying the strategy and decreases when a change occurs in the DJ Index and we start to make a profit.

Break-even point

When the profit from the Call option or from the 2 Put options covers the cost of purchase, $3,000. This occurs when the index is at 130 points or 85 points.

In this case we use a strategy similar to the “Strip”, known as a “Strap” (the next strategy).