| Market dATA | |

| DJ Index | 100 points |

| Prices | |

| Call 100 | $1,000 |

| Put 100 | $600 |

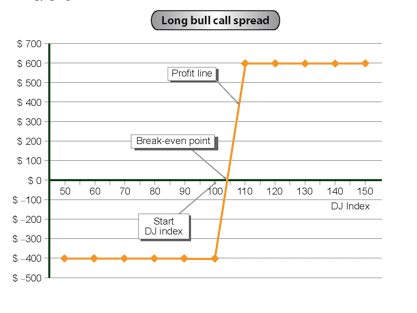

Strategy name:

Long “Bull Call Spread” (Rising Market Spread).

Recommended use of strategy

Expectation of moderate increase in the index, with a limited loss if we are mistaken and the index falls.

Strategy components

Buying a call option of a certain strike price.

Writing a call option of a higher strike price.

For example, buying a Call 100 option for $1,000 and writing a Call 110 for $600.

Expenses / Income from building the strategy

Expenditure of $400.

Strategy graph:

Auxiliary table for building the profit line

| DJ Index (Horizontal axis) |

(Fixed expenses)/ fixed income | Variable income (Call 100) |

Variable income (Call 110) |

Total profit / (loss) (Vertical axis) 2+3+4 |

| 1 | 2 | 3 | 4 | 5 |

| 50 | ($4,000) | — | — | ($400) |

| 60 | ($4,000) | — | — | ($400) |

| 70 | ($4,000) | — | — | ($400) |

| 80 | ($4,000) | — | — | ($400) |

| 90 | ($4,000) | — | — | ($400) |

| 100 | ($4,000) | — | — | ($400) |

| 110 | ($4,000) | — | $1,000 | $600 |

| 120 | ($4,000) | ($1,000) | $2,000 | $600 |

| 130 | ($4,000) | ($2,000) | $3,000 | $600 |

| 140 | ($4,000) | ($3,000) | $4,000 | $600 |

| 150 | ($4,000) | ($4,000) | $5,000 | $600 |

Strategy analysis:

Source of Profit

When the index goes up we profit on the Call 100 option.

But when it goes over 110, the additional profit is offset by the Call 110 we wrote.

When the index goes up we profit on the 2 Call options.

When the index goes down we profit on the Put option.

The profit is greater if the index increases.

Source of loss

The loss derives from buying the strategy, for which we paid $400.

The maximum loss is the cost of the strategy.

Break-even point

When the profit on the Call option equals the cost of the strategy – $400.

This occurs when the index is at 104 points.