“In-the-money”, “On-the-money”, “Outside-the-money or “Out-of-the-money”

We are able to define three situations which can apply to options, being:

- “In-the–money” – A situation where it is worthwhile exercising the option.

- “Out-of-the-money – A situation where it isn’t worthwhile exercising the option.

- “On-the-money” – A situation where for all practical purposes it is not worthwhile exercising the option.

The following table shows us when a Call option is in each of these situations and when a Put option is in each of these situations:

|

Definitions |

Call Options |

Put Options |

| 1. Option in-the-money |

Where the strike price is lower than the DJ Index |

Where the strike price is higher than the DJ Index |

| 2. Option on-the-money |

Where the strike price equals the DJ Index |

Where the strike price equals the DJ Index |

| 3. Option outside-the- money |

Where the strike price is higher than the DJ Index |

Where the strike price is lower than the DJ Index |

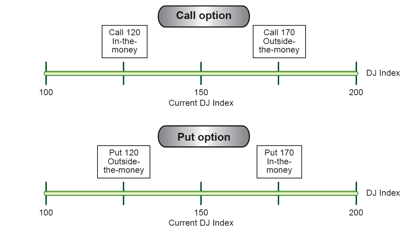

The following Schedule demonstrates the statements contained in the Table.

The situation of the option is of particular importance at the exercise date.

When the option is in-the-money it is worth exercising it.

When the option is outside-the-money, it is not worth exercising it.

When the option is on-the-money, it is also not worth exercising it (the option is worth 0).