| Market dATA | |

| DJ Index | 100 points |

| Prices | |

| Base asset price | $10,000 |

| Put 100 | $1,000 |

Long “Covered” Put

Recommended use of strategy

Expectation of an increase in DJ Index, but with concern that the index could fall.

Strategy components

- Purchasing (Long) the base asset – the DJ Index or a mutual fund investing in the DJ shares (see page 9).

- Purchasing a Long Put option at a strike price equal to the DJ Index.

Example: Purchase (Long) the base asset at a price of $10,000 and purchase a Long Put 100 option for $1,000. The strategy is known as a Short Futures Contract since this combination creates an obligation (contract) to sell the DJ Index at the exercise date at its current price (100 points – $10,000).

Expenses / Income from building the strategy

Expenditure of $11,000.

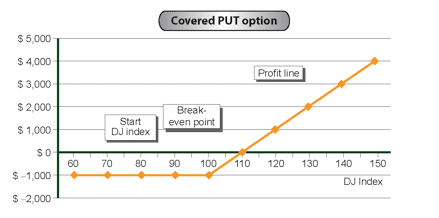

Strategy graph:

Auxiliary table for building the profit line

| DJ Index (Horizontal axis) |

(Fixed expenses)/ fixed income | Variable expenses (Put contribution) |

Base Asset contribution | Total profit / (loss) (Vertical axis) 2+3+4 |

| 1 | 2 | 3 | 4 | 5 |

| 60 | $11,000 | $4,000 | $6,000 | ($1,000) |

| 70 | $11,000 | $3,000 | $7,000 | ($1,000) |

| 80 | $11,000 | $2,000 | $8,000 | ($1,000) |

| 90 | $11,000 | $1,000 | $9,000 | ($1,000) |

| 100 | $11,000 | — | $10,000 | ($1,000) |

| 110 | $11,000 | — | $11,000 | $0 |

| 120 | $11,000 | — | $12,000 | $1,000 |

| 130 | $11,000 | — | $13,000 | $2,000 |

| 140 | $11,000 | — | $14,000 | $3,000 |

| 150 | $11,000 | — | $15,000 | $4,000 |

Strategy analysis:

Source of profit

The profit arises from the investment in the mutual fund. The profit increases as the index goes up.

Source of loss

Cost of building the strategy – $11,000. However when the DJ Index goes down, we lose on the mutual fund investment but are fully compensated by the Put option.

Break-even point

This occurs at index 110.

Comment

This strategy is a form of purchasing “insurance” against the risk of a fall in the value of the DJ Index shares basket.