| Market dATA | |

| DJ Index | 100 points |

| Prices | |

| Call 100 | $1,000 |

Strategy name:

Short Call option

Recommended use of strategy

Expectation of decline in DJ Index

Strategy components

Writing a Call option

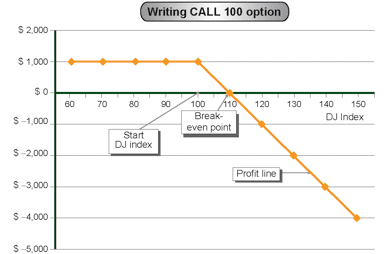

Example: Writing Call 100 at a price of $1,000

Expenses / Income from building the strategy (at start date)

Income of $1,000

Strategy graph:

Auxiliary table for building the profit line

| DJ Index (Horizontal axis) |

(Fixed expenses)/ fixed income | Variable expenses | Variable income (Call contribution) | Total profit / (loss) (Vertical axis) 2+3+4 |

| 1 | 2 | 3 | 4 | 5 |

| 60 | $1,000 | — | — | $1,000 |

| 70 | $1,000 | — | — | $1,000 |

| 80 | $1,000 | — | — | $1,000 |

| 90 | $1,000 | — | — | $1,000 |

| 100 | $1,000 | — | — | $1,000 |

| 110 | $1,000 | ($1,000) | — | $0 |

| 120 | $1,000 | ($2,000) | — | ($1,000) |

| 130 | $1,000 | ($3,000) | — | ($2,000) |

| 140 | $1,000 | ($4,000) | — | ($3,000) |

| 150 | $1,000 | ($5,000) | — | ($4,000) |

Strategy analysis:

Source of loss

The loss arising from writing the Call option. As the DJ Index increases, so does the loss increase.

Source of profit

The profit from building the strategy (writing the option) – $1,000.

Break-even point

The point where the losses from the option equals the income from writing it. This occurs at 110 points.