Introduction

This section explains a very interesting phenomenon: the aggregate checking account balances of the public can be larger that the amount of money in the bank vault.

Furthermore, the value of checking accounts in the hands of the public grows as the bank gives more loans, while the amount of money that is in the bank vault remains constant (when the inhabitants keep their money only in checking accounts) or even decreases (when the inhabitants also keep a portion of their money in cash).

It may be difficult to grasp how the total value of the checking accounts in the hands of the public can be greater than the amount of currency in the bank vault.

The explanation will use many illustrations to help explain the reason: the bank’s loans to the public. In the first example, Alan deposits $1 (called the ‘magic dollar’) at the bank. This makes his checking account balance $1.

If the bank lends Benjithe dollar that Alan deposited, and Benji immediately deposits it in the bank, then Benji’s checking account balance will also be $1

This example assumes the following:

- Alan, Benji, and the other bank customers in this example have no previous checking account balances.

- The bank has opened a new vault, and the money of the customers in the example will be deposited exclusively in this vault.

After Benji deposits the dollar in the bank, the bank can continue to lend the same dollar to Jerry, Diana, and Helen, in that order. Each of them in turn re-deposits the dollar in the bank, thereby increasing his or her checking account balance by $1.

The same single dollar, the magic dollar, becomes the source of the checking accounts of all five customers in the example.

The checking account balances of all five customers total $5, while there is only one dollar (the magic dollar) in the bank vault.

There are 3 elements in the following scenarios:

1. Currency.

2. Checkng accounts, also called current accounts or demand deposits.

3. Loans.

The Process of Making Loans

The process of a bank loan can be followed by observing the bank in Country A under Situation I, in which the inhabitants make payments exclusively by check. At this point, the money supply in Country A totals $10,000.

Let the situation in which no loans have yet been given be the Starting Point at Time A.

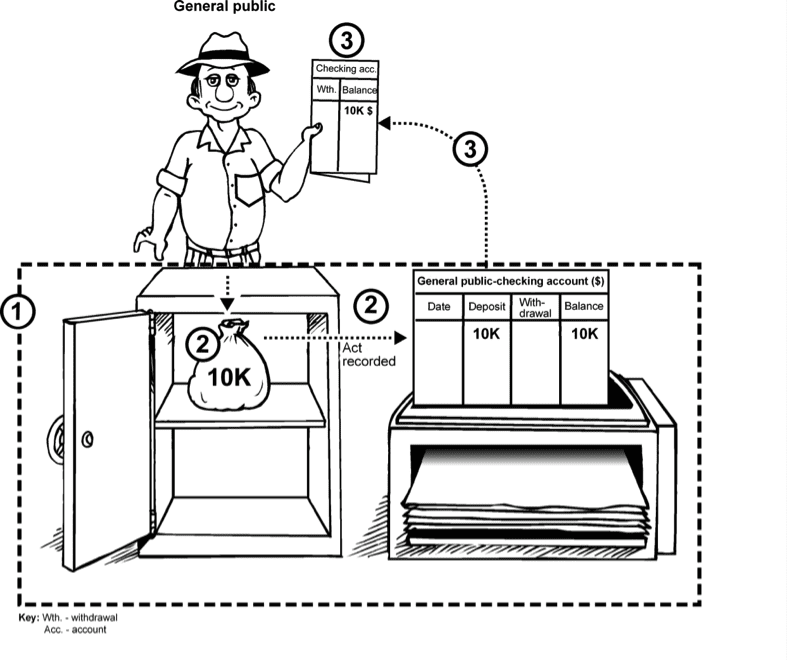

All the inhabitants in the country at Time A are presented as one entity, depicted in Illustration 7.7, called the “general public”. Anyone who later receives a loan will be presented separately from the “general public”.

Illustration 7.7

Explanation of Illustration 7.7

|

Number |

Explanation |

|

j |

General: The area bordered by the broken line represents the bank premises. |

|

k |

The General Public deposits $10k in the bank (represented by a vault). This is recorded in the general public’s checking account. |

|

l |

The General Public receives its checking account statement, which shows that the balance in the account is $10k. |