Caution – Danger of Bankruptcy

In the present situation, if the inhabitants of the country decide to withdraw all of their money in cash, they will come to the bank, write checks for $6,500 (the amount that they have in checking accounts), and wait for the teller to bring the money from the vault. Unfortunately, there is only $3,500 in the vault, which is not enough for everyone.

The bank will become “insolvent” – or in other words, “bankrupt”. As explained below, the probability of a situation like this is negligible.

Third Loan

The Golden Hotel Company applies for a $7,000 loan, but the bank cannot fully grant this request, for two reasons:

- The bank has only $3,500.

- If the bank lends the company $3,500, it will fall below the 0.25 minimum reserve ratio.

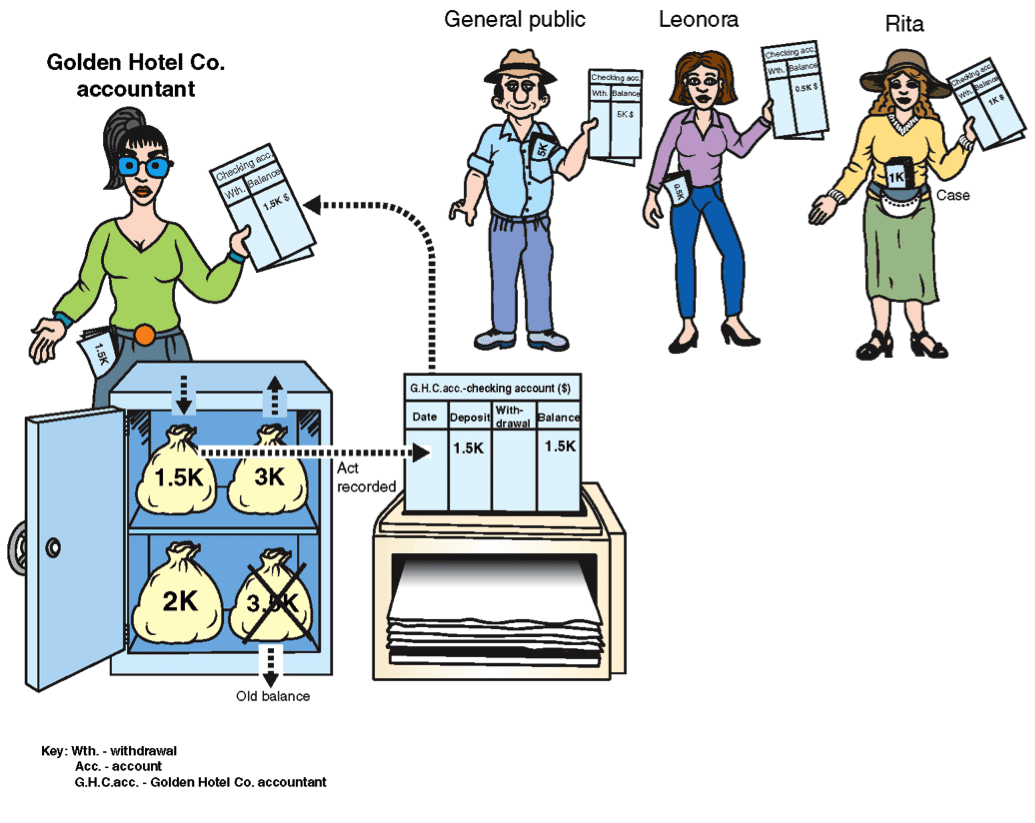

After granting a $3,500 loan, the situation would be as shown in Illustration 7.14.

Illustration 7.14

In this situation, the reserve ratio is 0.21 = (Total Cash in the Bank $1,750)/ (Total Checking Account Balance $ 8,250)

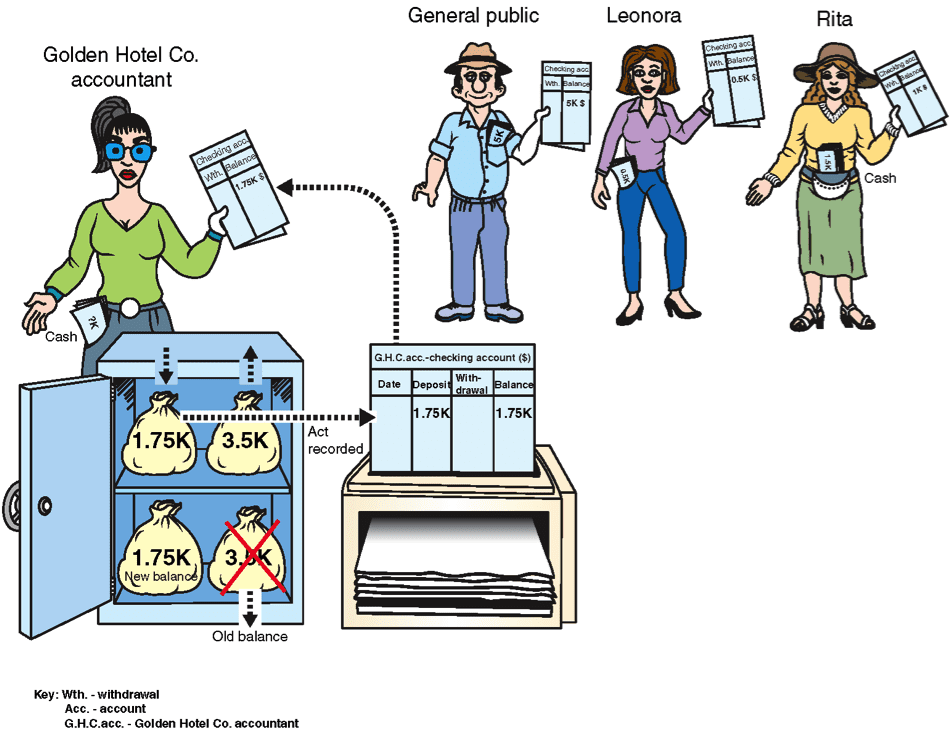

The bank holds reserves of $0.21 for each $1 on deposit, but is required to hold at least $0.25 for each $1 on deposit (minimum reserve ratio 0.25). The maximum loan that the bank can make to Golden Hotel is therefore $3,000.

In this case, the situation would be as depicted in Illustration 7.15.

Illustration 7.15