Had the minimum reserve ratio in Country A been set at 0.2, i.e., if the bank had been required to hold $0.20 in its vault for every $1 on deposit in a bank account, then the bank would be able lend an additional $533, and then half of this amount would be deposited into bank accounts and returned to the bank vault.

The reserv ratio would be 0.2 = $1,333/ $6,667

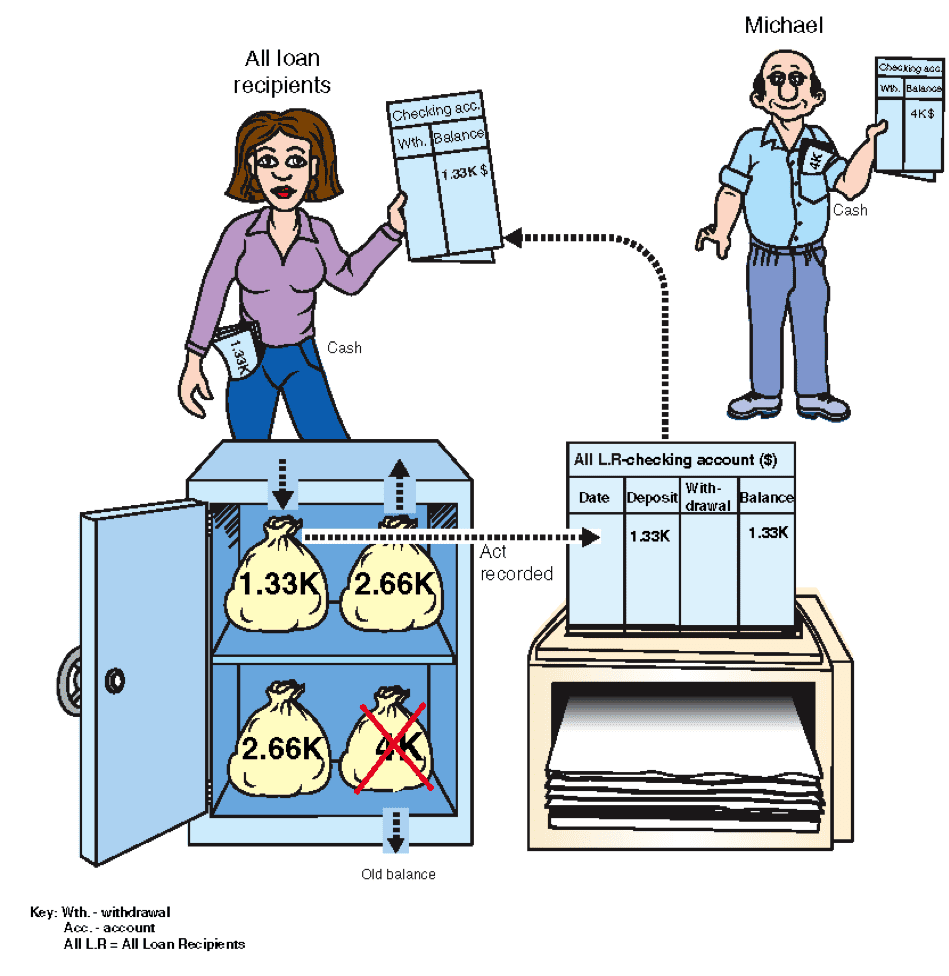

On the other hand, had the minimum reserve ratio in Country A been set at 0.5, then the bank would have needed to reduce the scope of the loans already granted to the public. Total loans to the public could amount to only $2,666.

This situation is shown in the following illustration.