Mainly due to an established government framework, the process in the US for financing mortgages is the most advanced the world. There are a number of government and semi-government companies that buy mortgages from banks. In order to finance these purchases, these companies issue bonds to the public.

Securitization

There are three companies that the US government established in order to purchase mortgages. These three companies finance their operations by issuing bonds. Their obligations to the bondholders they finance with the payments they receive on the mortgages.

This process of purchasing mortgages and issuing bonds backed by those mortgages is called Securitization.

The three leading companies in this field are:

- Fannie Mae – Federal National Mortgage Association.

- Freddie Mac – Federal Home Loan Mortgage Corporation.

- Ginnie Mae – Government National Mortgage Association.

Mortgage-Backed Securities

Bonds issued by these three companies are generally called Mortgage-Backed Securities since the asset portfolio, which is used to redeem these bonds, is made up of mortgages.

Secondary Mortgage Market

The market where these bonds are purchased is called the secondary mortgage market. Securitization returns cash to the banks, which then allows them to issue more loans. The securitization companies serve as middlemen in this mortgage market.

Mortgage-backed bonds are generally issued with a par value of $10,000 or more. For this reason, many investors do not buy them directly but through a mutual fund that specializes in mortgage-backed securities.

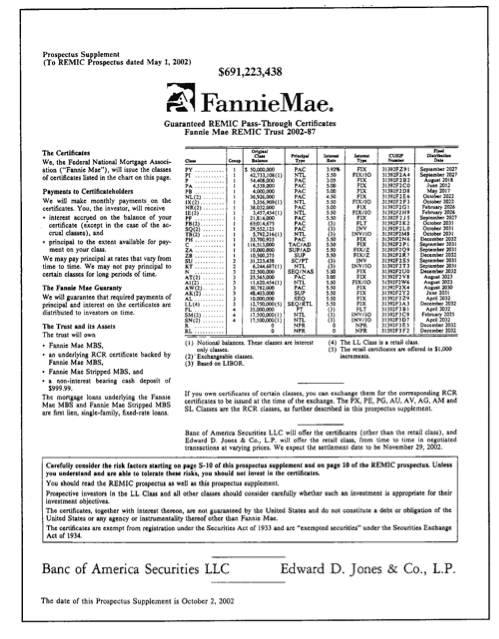

Cover Page of a Mortgage-Backed Security Issue Prospectus