REIT is the status that a real estate cooperative can receive in the US. In order to be classified as a REIT, the cooperative must meet two main conditions.

- Distribute an annual dividend of at least 90% of its taxable income.

- The majority of its income must come from either rent or interest from mortgages.

Advantages of REIT Classification

Being classified as a REIT exempts the cooperative from taxes. The individual dividend recipients, according to their income bracket, pay taxes instead.

Market Listing

Most REITs are listed for trade in American stock markets. Their shares trade like ordinary stock.

Historical Background

REITs were created by Congress in the Sixties to allow small private investors to take part in large profitable real estate projects. It was understood that the only way for small investors to be involved in such projects was by investing in a trust, similar to how he can buy stock in other public corporations.

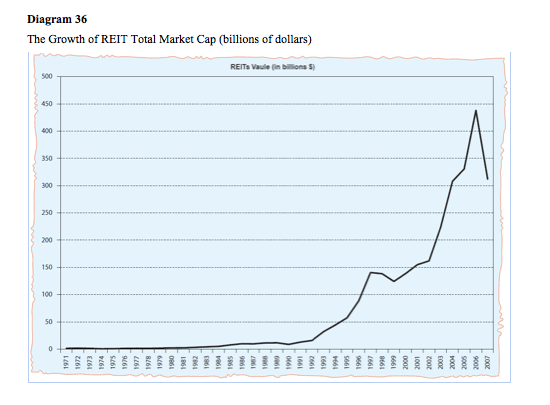

REITs became popular in the Nineties, in light of the ongoing real estate crisis. At that point, real estate prices were attractively low, and many people wanted to invest. Beginning in 1,992, REITs assumed a growing position in the real estate market.

Today, there are approximately 300 active REITs and most of them are traded in the three largest exchanges.

Diagram 36 presents the growth of the REITs’ market cap.

Three Types of REITs

REITs are separated into three main types:

- 96% are Equity REITs that specialize in income-producing real estate.

- Mortgage REITs that invest in mortgages account for 2% of REITs.

- The remaining 2% are Hybrid REITs, which combine both types of investment.

Amidst equity REITs, there are eight different sectors that funds might specialize in, as is detailed in Chart 37. In addition, trusts might specialize in a specific geographic location, or they might choose to spread their investments out.

Chapter 37

REITs, by Investment Sector

| 1 | Industrial REITs |

| 2 | Office REITs |

| 3 | Residential REITs |

| 4 | Commercial REITs |

| 5 | Lodging REITs |

| 6 | Health Care REITs |

| 7 | Storage REITs |

| 8 | Speialty REITs |