Full Name: National Association of Securities Dealers Automated Quotation.

Short Name: NASDAQ.

Location: A network of computers spread out across the US and the rest of the world.

Established: 1971.

Number of Companies Listed, 2010: Approximately 2,900.

The NASDAQ is a “screen based” exchange. It operates through a network of computers around the world. Financial institutions such as banks and brokerage firms are connected to this network. Through this network they receive information on stock prices and perform transactions.

Thousands of companies are traded through the NASDAQ, the majority of which are high tech firms active in the following sectors:

- Computers.

- Internet.

- Communication.

- Biotechnology.

- Medical Equipment.

In addition, some other established companies that are not involved in the high tech field are also listed on the NASDAQ.

Trading Method

Every stock traded on the NASDAQ has a number of market makers. Market makers buy and sell shares of those stocks from the public. Like the NYSE’s specialists, market makers are responsible to maintain continuous trading on their stocks. Market makers constantly publish two prices:

- The price they are willing to buy the stock at – BID.

- The Price they are willing to sell the stock at – ASK.

The gap between these two prices is called the spread, and it is the main profit source for the market makers.

Market makers are generally large investment institutions, or t hey are companies that specialize in being market makers. Different market makers that represent the same stocks compete between themselves for clients. For example, if an investor wants to sell one hundred stocks of Intel, he will sell them to whichever market maker offers the highest price. There are more than 500 active market makers.

On average, each stock listed on the NASDAQ has ten market makers, but there are some stocks that are very heavily traded, and they can have fifty ore more market makers.

Chart 2 lists the ten biggest market makers on the NASDAQ.

Chart 2

The Ten Largest Market Makers on the NASDAQ, January 2003

| Market Maker | Number of Stocks it represents |

| Spear, Leeds & Kellogg | 4337 |

| Knight Securities | 4122 |

| Herzog , Heine , Geduld | 3766 |

| Schwab Capital Markets | 1982 |

| Morgan stanley | 1302 |

| Salomon Smith Barney | 1149 |

| Merril , Lynch , Pierce, Fenner | 962 |

| Credit Suisse First Boston | 712 |

| Lehman Brothers | 665 |

| Golden Suchs & co. | 529 |

The party that is responsible for the NASDAQ and that maintains it is the NASD – National Association of Securities Dealers.

It is important to keep in mind that there is a difference between the NASDAQ market that we have just described and the NASDAQ index which will be explained later.

Getting Listed on the NASDAQ

There are two ways to get listed on the NASDAQ.

Method 1 – The NASDAQ National Market

This is the way large, established companies such as Microsoft and Intel are listed. In order to be listed here, a company must meet a number of requirements, including:

1. Have at least 1.1 million outstanding shares.

2. Have a market cap of at least 8 million dollars.

3. Have net assets of at least 15 million dollars.

Method 2 – The NASDAQ Small Cap Market

Younger, smaller companies can be listed this way, with easier requirements.

1. Have at least 1 million outstanding shares.

2. Minimum market cap: 5 million dollars.

3. Minimum net assets: 5 million dollars.

The NASDAQ Top 10

The top ten companies with the largest market cap on the NASDAQ are listed in table 3.

Table 3

The Ten Largest Corporations on the NASDAQ, March 2010

| Corporation | Ticker | Market Cap (in billions of dollars) March 2010 |

| Microsoft Corporation | MSFT | 260 |

| Apple | AAPL | 203 |

| GGOG | 180 | |

| Cisco Systeam | CSCO | 150 |

| Oracle Corporation | ORCL | 128 |

| Intel Corporation | INTC | 123 |

| Vodafone Group | VOD | 120 |

| Qualcomm | QCOM | 65 |

| Amazon.com | AMZN | 58 |

| Amgen | AMGN | 56 |

Trade Volume

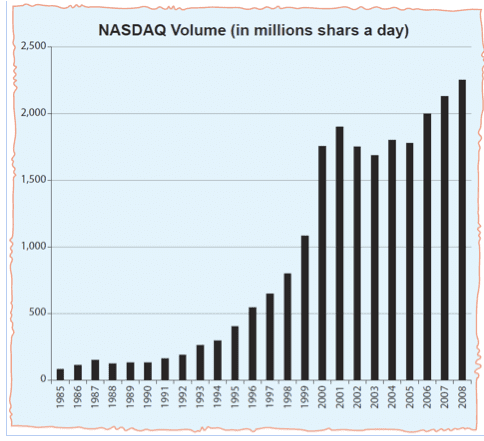

The NASDAQ’s success can be seen in diagram 4 which presents the development of the daily trading volume at the market.

- In 1,985, on average, less than a hundred million shares were traded a day.

- In 2,008, the daily average was over 2.2 billion shares.

Diagram 4

The NASDAQ’s Daily Volume (Millions of Shares)