When a company issues stocks that have never been traded before, it is called an initial public offering. The activity involved in IPOs is called the primary market. Trading on already existing securities is called the secondary market. The US has a very developed primary market, and during periods of growth firms can use IPOs to raise billions of dollars from the investment community.

The IPO Process

Underwriter

A corporation that is interested in issuing shares to the public chooses an investment bank that will serve as the primary underwriter that will manage the IPO. The primary underwriter stands at the head of a group of underwriters whose job, at the end of the day, is to buy stock from the company and sell it to the public.

Registration Statement

At the beginning of the process, the company prepares a draft prospectus called the Registration Statement. The draft presents the company’s activities, its financial situation, its senior management, and information about the securities the company is interested in selling to the public. The SEC examines the draft and decides whether or not to approve it.

Roadshow

Once the SEC approves the IPO, a process begins to determine what price the shares will be offered at. During this process, representatives of the company and of the underwriters meet with institutional investors, such as managers of mutual funds, pensions, and the like, and present the company and its offer. This stage is called the Roadshow and its purpose is to find out how much interest there is in the market for the offering.

Prospectus

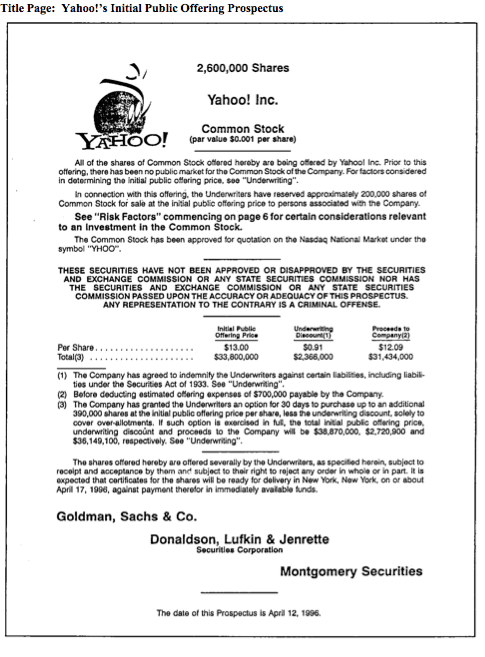

Ahead of the offering’s date, a final price is set and a Prospectus is distributed. The prospectus contains details on IPO, information on the company’s activities, financial situation, and the risk involved in buying these new stocks.

The Offering

During the offering itself, the underwriters buy the shares from the company at a slight discount from the price offered the public, and sell them to the public at full price. The underwriters make their profit from this discount. After the offering, the stock is traded like any other.

Table 13 presents the amount of capital that was raised by American companies through IPOs in the past few years.

Table 13

Capital Raised Through IPOs in the US

| Year | Capital (in billions of dollars) |

| 2007 | 60 |

| 2008 | 28 |

| 2009 | 22 |

Table 14 presents some examples of IPOs from the past few years that highlight the size of the IPO market, and its importance for raising capital.

Table 14

| Company | Sector | Capital (in billions of dollars) |

Date |

| Agricultural Bank of China | Financial | 19.2 | Jult , 2010 |

| Visa | Financial | 17.9 | October , 1988 |

| AT & T wireless | Communications | 10.6 | April , 2000 |

Examples of Large Initial Public Offerings

Click here for further examples.

Recently, parties connected to the underwriters have been receiving priority over the general public. Therefore, investors that are interested in taking part in IPOs need to very careful. It is recommended that investors that are not close to either the issuing corporation or the underwriters not invest in IPOs unless they have fully investigated the offering, and are certain that they are happy with the offered price.

The following page presents the cover page of the Yahoo!’s IPO prospectus.