An Empirical Study of the Differences between Share Price and Asset Value

A simple historical analysis shows that while on 80% of trading days there is a difference between the share prices of ETFs from their asset values, that gap is less than 0.25% wide. For example, for a fund whose shares have an asset value of 100 dollars, on 80% of trading days, the share price will not be equal to 100 dollars. However, it will be between 99.75 and 100.25 dollars.

Advantages of Investing in ETFs

Investing in ETFs has a few advantages over investing in ordinary mutual funds.

- Combines the Advantages of Mutual Funds and Ordinary Stocks

ETFs give the investor the best of both worlds. One the one hand, he gets to diversify his investments as if he was investing in a mutual fund, and on the other hand, he gets to hold a security which can be traded in the stock market like a regular corporate share.

- A Known Price at all Times

The share price of a regular mutual fund is calculated at the end of every trading day. On the other hand, ETFs have a share price which changes constantly during trading.

- Traded Like Stocks

All of the transactions that can be ordered for regular stocks can also be ordered for shares of ETFs. Limit orders and the like which can not be placed on mutual funds can be used for trading ETFs.

Historical Background

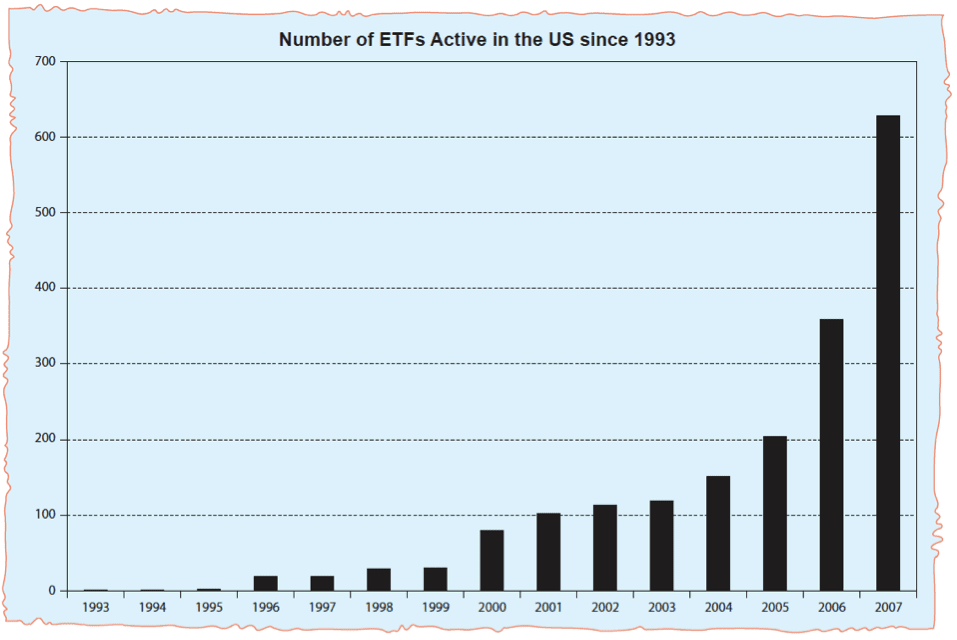

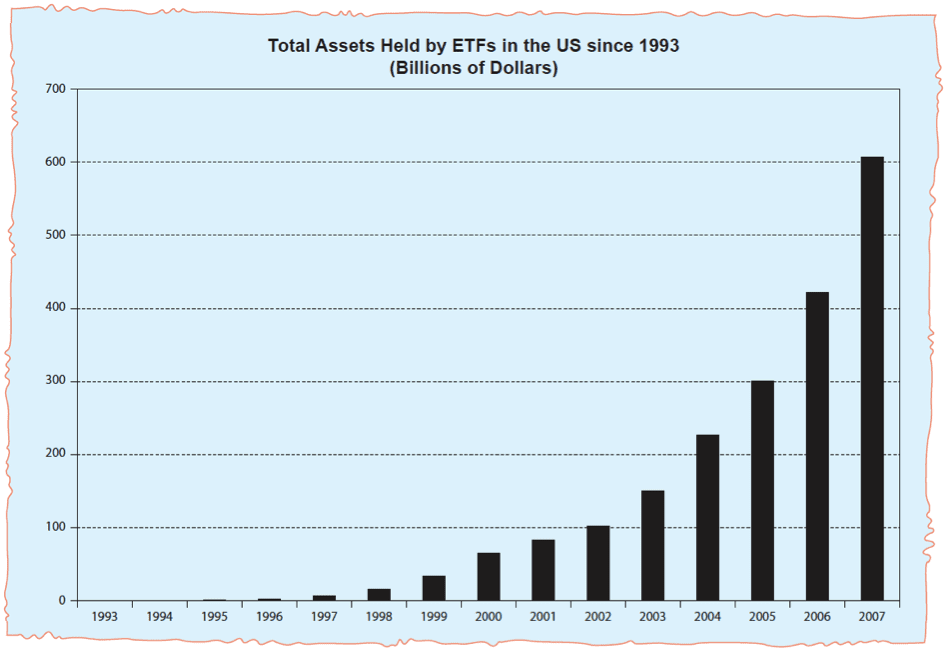

ETFs began in the United States in the early 90’s and quickly succeeded. Beginning in 1993, there has been a constant rise in the amount of capital invested in ETFs. Correspondingly, the number of ETFs active in the market has continued to grow. Charts 18 and 19 display the growth of ETFs. Chart 18 displays the assets that ETFs hold while chart 19 lists the number of ETFs that have been active.

Diagram 18 –

Diagram 19