The Public is only capable of buying and selling ETF shares in an exchange. In addition, Institutional Investors, can make arrangements with the fund’s directors to have new shares created, or to redeem existing changes. As we will see shortly, this option insures that the market price of the fund’s shares is close to their asset value. Otherwise, it would be determined by supply and demand for the fund. Creation and redemption of shares occurs only in huge quantities of 50,000, 200,000 shares and the like. Each fund has its own rules.

In Practice, a Share Price is linked to its Asset Value

To demonstrate, we will follow the price of a share of Spiders. Its asset value is calculated as followed: One dollar times one tenth of the S&P 500 index. Let’s assume that the S&P 500 is at 800 points. In this case, each share has an asset value of 80 dollars.

- If, as a result of higher demand, the price of a share on the market reaches 81 dollars, the institutional investors will ask the fund director to create new shares, at 80 dollars a share. They will then sell those shares at their market value of 81 dollars, receiving a profit of a dollar a share. However, this increased supply will quickly lower the price, until it is again equivalent to the value of the fund’s assets per share, 80 dollars.

- On the other hand, if the price should fall to 79 dollars a share, the institutional investors will want to buy up shares and redeem them for 80 dollars a share. However, their purchases will raise demand, and bring the price back to 80 dollars.

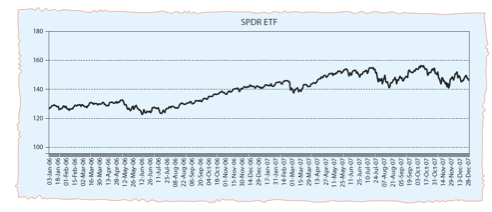

A Visual Demonstration of the Connection between the Share Price and the Target Index

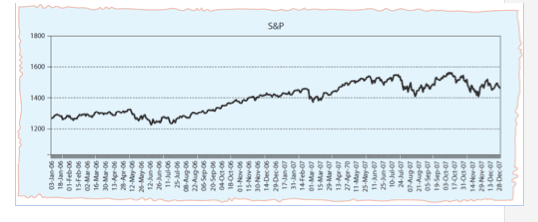

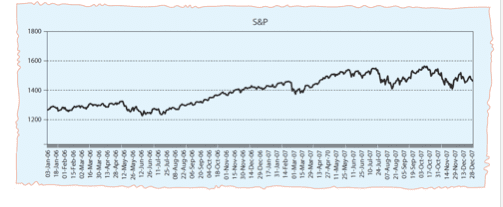

Graph 16 presents the changes in the S&P 500 over the course of the years 2006-2007. Here, the units are index points.

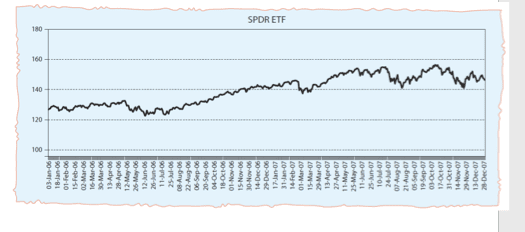

Graph 17 shows the share price of the Spiders fund during that same period. The price is measured in dollars.

Graph 16

S&P 500 Index, 2006 – 2007

Graph 17

Share Price of the Spiders Fund, 2006 – 2007

There is a perfect correlation between these two charts. In other words, the changes in the S&P 500 index are exactly the same as the changes in the price of the Spiders fund.