When you write a Put option, you undertake to purchase a house the underlying asset from the option holder, if he so requests, at the mentioned exercise price.

We Assume that on Date A:

House prices in the market stand at $98K.

You write a Put option “June 100 P H” for a premium of $5K (internal value 2, time value 3(.

We will consider what the profit or loss will be from writing the option taking into cosideration the price of houses on date B, in 3 different scenarios.

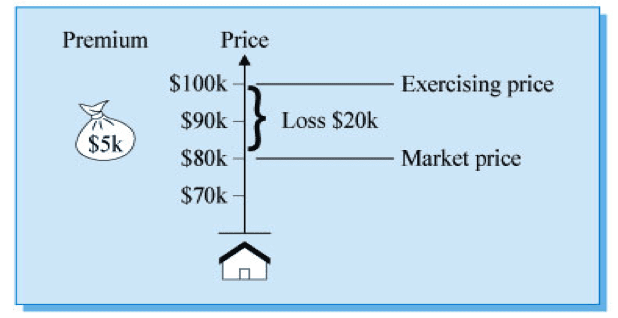

Scenario 1 – The price of houses in the market drops to $80K

Under this scenario, the holder of the option will want to exercise it. You will be forced to purchase the house for $100K and sell it to the option holder for $80K. In this case you lose $20K on the option and $15K as a whole on the transaction.

Diagram 15 shows the situation

Scenario 2 – The price of houses in the market increases to $120K

Under this scenario, the option holder will not want to exercise it since he can sell the house in the open market for $120K. You make a profit equal to the amount of premium ($5K).

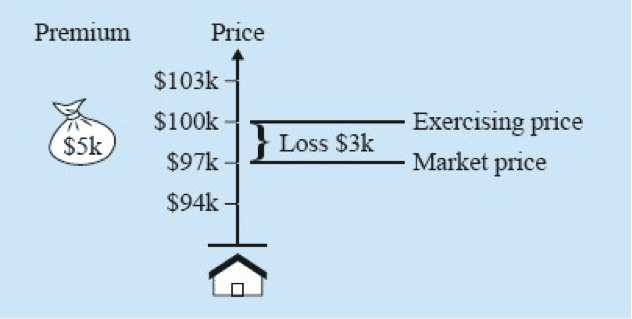

Scenario 3 – The price of houses in the market drops to $97K

Under this scenario, the option holder will want to exercise the option. You will lose $3K on the option but make a profit of $2K as a whole on the transaction.

Diagram 16 shows the situation

Writing a Put option – main characteristics

- The basic use is when we expect an increase in the price of the underlying asset.

- We can only lose from writing the option.

- We expect to profit on the transaction, by means of the premium we received.