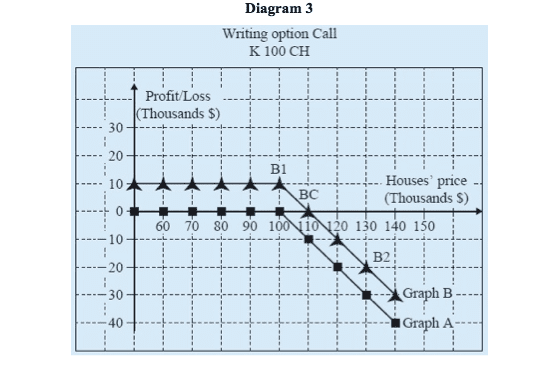

Graphic presentation of the profit (loss) on date B.

Graph 3 shows us the profit or loss arising on Date B from writing a “100K C H” option.

We received $10K for the option.

Graph A shows what our gross loss will be from the writing of a Call option at any level of price in the market for houses on Date B. Graph A does not rise above the $0 line, which means that if you do not receive a premium, you are bound to make a loss.

Graph B shows us what our profit or loss will be on the transaction (net profit), at the same price levels on Date B.

For example:

Point B2, shows a loss of $20K on the transaction, if house prices are at $130K.

Explanation: If the purchaser wants to exercise the option, we will be forced to buy the house in the market for $130K and to sell it to the option holder for $100K, the exercise price.

The loss on the option: -$30K = $100K – $130K.

The loss on the transaction: – $20K = -$30K + $10K.

Point B1 shows a profit of $10K on the transaction, if house prices are at $100K.

At any price below $100K (leftwards from Point B1) we continue making $10K, in other words there is no way to make a profit of more than $10K, which is the amount of the premium.

From B1 rightwards, any $1K increase in prices draws us down by $1K.

At Point BC we are “balanced”. Any additional increase of $1K in the price of houses results in a loss of the same amount. As house prices increase above the break-even point, so the loss increases!