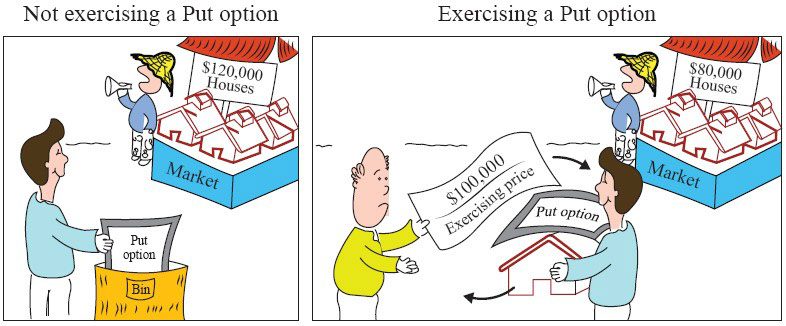

A Put option is a security giving us the right to sell an asset, known as the “underlying asset” (for example: a house), at a price agreed in advance, which is known as the “exercise price”. The option has a limited duration. The option also contains a definition of the “underlying asset”, what the terms of sale are and the duration of the option.

Exercising the Put Option

We would exercise the Put option only if we are able to sell the underlying asset at a price higher than the market price. If this cannot be done, we will throw the option away.

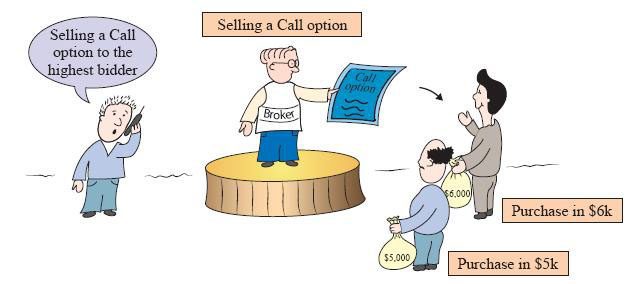

Options Trading

Most options are traded in a stock market. This means that the stock market acts as an intermediary between buyers and sellers of options. The brokerage is carried out in the stock market. The prices of the options, as we previously stated, are referred to as the “premium”, and they change during trading, according to the supply and demand, in exactly the same way as the prices of shares vary. At the start of trading you can buy a particular option for a premium of $10, and sell the option at the end of the trading day for $20. In this book, we will relate only to traded options and we will assume that the houses in the example are tradable. In other words, we can buy and sell the options on any day when trading takes place in the stock market.

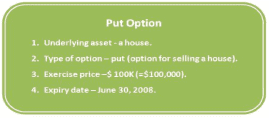

Put Options Explained – Characteristics

As previously mentioned, a Put option is an option to sell an underlying asset, for example an option to sell a house. The explanation for the four items of data in the following illustration is similar to the previous explanation about the call option.

Illustration 2- Example of Put option data