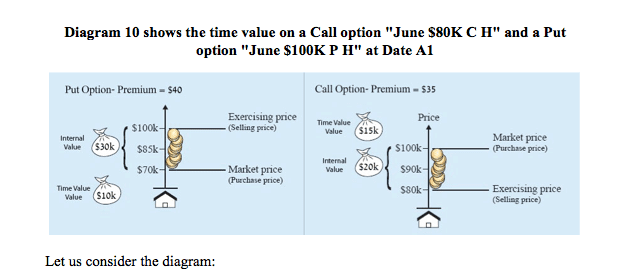

If you buy an option and pay a premium which exceeds the internal value of the option, the difference is known as the “time value“.

The time value is in fact the differences between the amount of the premium paid and the internal value of the option.

Call option

If you bought an option “June $70K C H” when the price of houses in the market was $100K and you paid a premium of $40K, the premium amount includes:

- Internal value – $30K.

- Time value – $10K.

The premium can thus be split into two component parts:

- the internal value

- the time value

Put option

If you bought an option “June $100K P H” when the price of houses in the market was $70K and you paid a premium of $40K, the premium amount includes:

- Internal value – $30K

- Time value – $10K

Buyers of options, who pay a premium with a time value, are expecting that time will be kind to them, and the market prices will move in their favor, until expiry date, that is:

- Buyers of Call options expect that market prices will increase.

- Buyers of Put options expect that market prices will decrease.

Premium with only time value

When an option has no internal value, the premium consists only of time value.