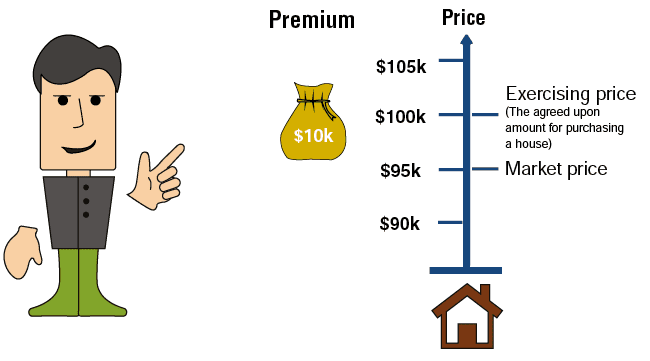

We will use an example for the purpose of the explanation. We will assume:

- We will buy option “June 100 C H”, an option to buy a house in June for $100K.

- On the date of purchase of the option (Date A), the market price of houses was $95K. The premium for the option is $10K.

The diagram shows the situation on date A:

We will now look at what our profit or loss will be from the option and from the transaction in 3 different scenarios, taking into consideration the market prices of houses on the date of expiry of the options (Date B).

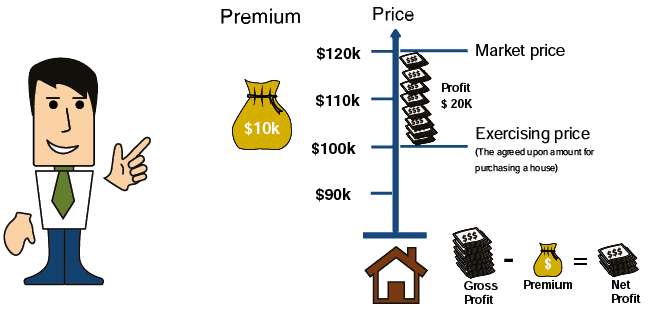

Scenario 1 – market price of houses is $120K

In such a scenario we should exercise the option. We will purchase from the writer of the option a house for $100K and sell it in the market for $120K – a profit of $20K from the option (gross profit). In order to calculate the profit from the transaction, we need to deduct $10k – the premium price we paid, and our total profit is $10K (net profit).

The diagram shows the situation:

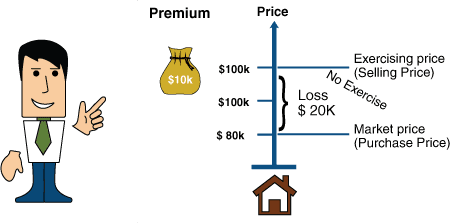

Scenario 2 – house prices – $80K

In this scenario, it is not worth exercising the option, since by exercising the option we would purchase a house for $100K, when its market price is $80K. In this scenario, we have not profited from the option. We would lose $10K on the transaction – the full amount of the premium we paid.

The diagram shows the situation:

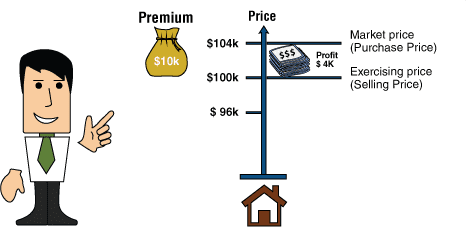

Scenario 3 – house prices – $104K

In this scenario, it is worth exercising the option, (the market price is higher than the exercise price). We would purchase a house in the stock market for $100K and sell it for $104K. The profit on the option is $4K, but since we paid $10K for the option, we lose $6K on the transaction. If we had not exercised the option, we would have lost $10K on the transaction.

The diagram shows the situation:

Direct Closing of Transactions in the Stock Market

In real life, there is no need to buy and sell the underlying asset to realize the value of an option. Instead, the owner of an option can sell it to other investors for a price that is equal to or greater than the value it could provide through exercise and sale of the underlying asset.

In the above case, we transfer the option we are holding in an options market, and it transfers at least $4,000 (the proceeds of exercise and sale) to us.

Buying Call Options – Important Characteristics

1. The basic use of Call options is when we expect an increase in the price of the underlying asset.

2. In respect of the option itself we can only profit. If we do not make a profit we, will not exercise the option.

3. In respect of the transaction, the loss is limited to the amount of the premium only.

Apart from the premium payment, we have no other expenses.