As we have just seen, and we see more extensively as we go forward, option writers risk unlimited losses. In respect of the risk they are taking on, they demand full payment, which is expressed in the “time value”. The further away the expiry date, their exposure to risk is longer and naturally the premium will include a larger time value.

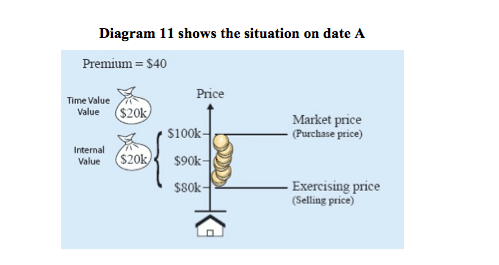

Let us assume that on date A (January 1, 2008):

1. The price of houses is $100K.

2. We buy option “June 80 C H”, which means the right to buy a house in June for $80K.

3. The premium demanded: $120K (The premium reflects an assessment that on the expiry date, the price of houses on date B will reach at least $120K)

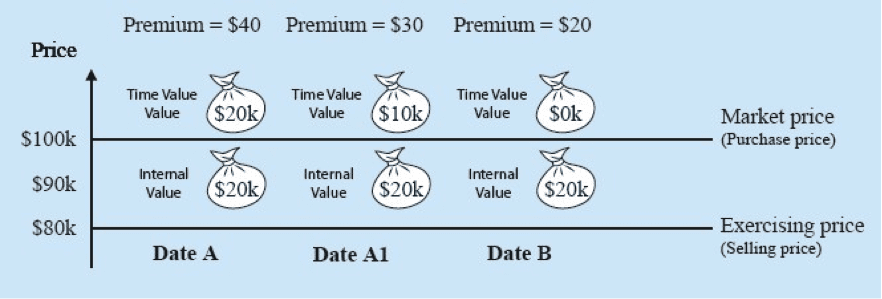

If the prices of houses remain steady until Date B (June 30, 2008), the premium at the expiry date will be only $20K, and will include only the internal value – and the time value will be $0. Nobody would be prepared to pay even a single cent more than the internal value, since you would end up paying more for the house than its market price.

Or from another point of view: A person paying a premium of $20K plus one cent will lose one cent on the transaction (he will gain $20K on the option and pay a premium of $20K plus one cent).

Almost certainly if house prices remain steady until 31.3.08 (Date A1), the price of the premium will fall below $40K in view of the reduced risk of house prices reaching $120 on Date B. If the expectancy on Date A1 is that house prices on date B will be 110K, the premium will drop to $30K.

Diagram 12 shows in graphic form the development of the premium price between Date A1 and Date B if house prices remain steady.

Definitions of Status of Options

OPTIONS IN THE MONEY

When at any point in time it is worth exercising the option – we say that the option is in the money (the option is supposed to generate us money).

In this situation, the internal value of the option is greater than 0.

When it is very worthwhile exercising the option, we say that it is deep in the money.

OPTIONS OUT OF THE MONEY

When at any point in time it is not worth exercising the option, we say that the option is at that point in time out of the money (the option will not produce money).

In this situation the option has no internal value.

OPTIONS ON THE MONEY

This is the situation where the exercise price = the market price.

In this situation the internal value of the option = 0 (which means it has no internal value).

Internal value and time value -conclusion

The premium price can be split into two components:

1. Internal value.

2. Time value.

Premium Price = Internal Value + Time Value

Note

All the calculations presented in this book do not take into account the associated costs, such as: bank or broker commissions (for executing the transaction), custodian fees etc.

The associated expenses differ from bank to bank and from broker to broker, and the investor needs to check in advance their effect on the profitability of the investment.