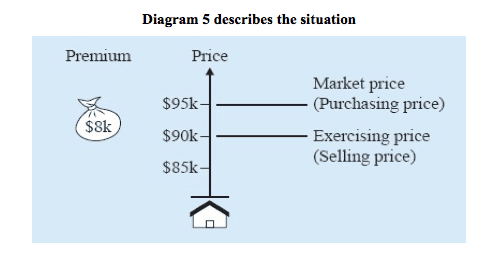

We relate our explanation to an example:

Given that:

1. We buy a Put option “June 90 P H”, which means: An option to sell a house in June for $90K.

2. The price of houses on the date of purchase of the option (Date A) – $95K.

3. We pay a premium of $8K for the option.

We will examine what our profit or loss will be on the transaction via 3 scenarios, regarding the price of houses in the market at expiry of the option (Date B).

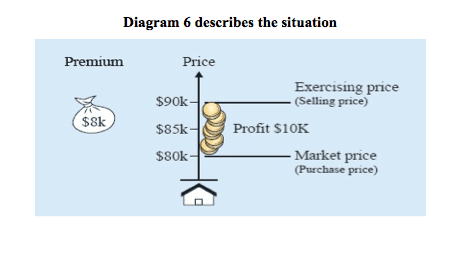

Scenario 1 – Market price of houses is $80K

Under this scenario it is worthwhile exercising the option.

We can buy a house in the market for $80K and sell it in the stock market for a price of $90K. Thus, the profit on the option will be $10K.

In order to find the profit on the transaction, we subtract the premium we paid, $8K, leaving a total profit of $2K.

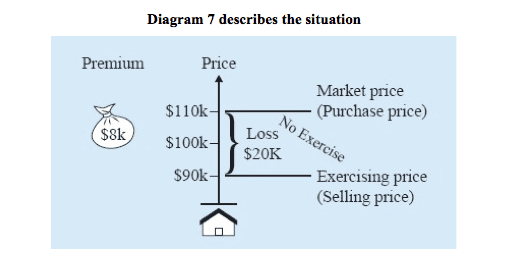

Scenario 2 – Market price of houses is $110K

Under this scenario we will not exercise the option. It is not worthwhile to purchase a house in the market for $110K in order to sell it in the stock market for $90K. We will lose $20K. Under this scenario, the option profit in 0, but on the transaction as a whole we lose the entire premium, a loss of $8K.

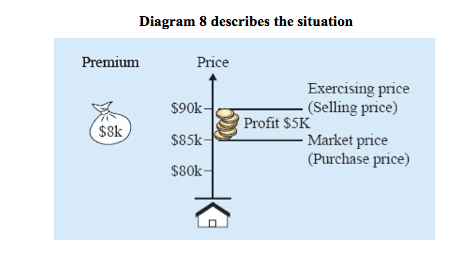

Scenario 3 – Market price of houses is $85K

Under this scenario it is worthwhile exercising the option. We make a profit of $5K on it, since we can purchase a house in the market for $85K and sell it in the stock market for $90K. Since we paid a premium of $8K, we make a loss of only $3K on the transaction.

If we do not exercise the option, we would lose $8K on the transaction.

As we can see, we make a profit on the option only if we can buy for cheap and sell at a higher price, which happens when the market price is lower than the exercise price.

Buying Put options – Main characteristics

The basic use of Put options is when we expect a decrease in the prices of the underlying asset.

2. In respect of just the option itself, we can only profit. If we don’t make a profit, we don’t exercise the option.

3. In respect of the transaction as a whole, the loss is limited to the amount of the premium only.