There are 3 reasons for writing a put option:

- Buying a house for low price (main reason).

- Ongoing income from premiums (main reason).

- Speculation.

Buying a house cheap

Let us assume that on date A the price of houses is $110K and you think that they are very high and feel that correct price should be $105K at which you will be prepared to buy a house.

In this situation, you can write a Put option “108K P”, with a premium of $3K. The price you pay for the house is the exercise price minus the premium you received.

If house prices fall below $108K, for example to $100K, you will be obligated to exercise the option and pay the option holder $108K for the house. But you received a premium of $3K, and thus the transaction costs you a total of only $105K. Whilst you will pay $5K more than the market price for the house, but when you decided on the purchase, $5K was regarded as cheap. You don’t need to be too disappointed.

Ongoing income from premiums whilst being prepared to buy the house cheap

The explanation for this case is similar to the example of buying the house cheap, except that if your main objective is to produce regular premium income, with your motivation for buying a house being less powerful, you can act in the following manner:

1. Write an option with a lower exercise price, for example “$103K P”. Naturally the premium for it will be lower.

2. When market prices approach the exercise price, you can cancel out the option by purchasing an identical Put option. However, if purchasing the option entails payment o a very high premium, you will decide not to buy the option, but instead will buy the house itself.

Speculation

Speculators expect the house prices will rise massively up to the expiry date, and they will make a profit on the premium and if the house prices fall, it will be less than the value of the premium.

Graphical representation of the profit (or loss) on date B:

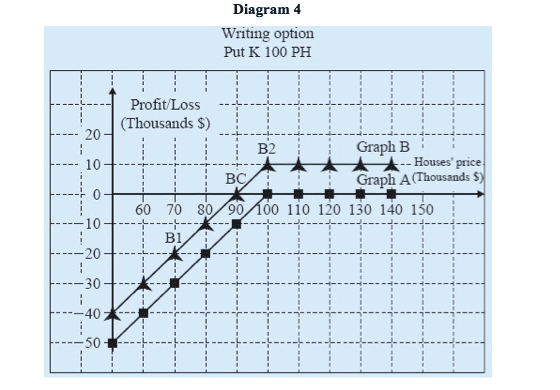

Diagram 4 shows the profit (or loss) arising on date B on the writing of an option “100K P H”, for a premium of $10K.

Graph A shows the loss (gross) from writing the Put option at any level of prices prevailing in the market on date B. Graph A does not rise above $0, meaning: If you don’t receive a premium, you will always be at a loss.

Graph B shows our profit or loss on the transaction (net profit), at the same price levels on date B.

Example:

Point B1, shows a loss of $20K on the transaction, if house prices are at $70K.

Explanation: If the option holder wants to exercise the option, we will be forced to buy the house from him for $100K (the exercise price) whilst the market price $70K.

The loss on the option: -$30K = $70K – $100K.

The loss on the transaction: – $20K = -$30K + $10K.

Point B2 shows a profit of $10K on the transaction, if house prices are at $100K.

At any price above $100K (rightwards from Point B2) we continue making $10K, in other words there is no way to make a profit of more than $10K, which is the amount of the premium.

From B2 leftwards, any $1K decrease in prices draws us down by $1K.

At Point BC we are “balanced”. Any additional decrease of $1K in the price of houses results in a loss of $1K. As house prices decrease, so the loss increases!