Measure 1

Increasing public consumption at the initiative of the government

This is obvious and there is no need to elaborate.

Measures 2

Cutting the interest rate in the economy

Cutting the interest rate in the economy impacts two factors:

- It increases private consumption.

- It increases investment.

Explanation – when the interest rate falls:

- Saving becomes less attractive, and consumers therefore use some of their savings to buy goods. At the same time, enterprises spend part of their savings to buy machinery and equipment (investment goods).

- It is tempting to take out loans. Consumers take out loans to buy goods, and enterprises take out loans to buy machinery and equipment (investment goods).

Measure 3

Cutting taxes

This measures has the following effects:

- It increases private consumption since people retain more money in their pockets.

- It increases investment – enterprises are also left with more money in the bank, some of which will be spent to buy investment goods.

Note

If cutting taxes is accompanied by a cut in government spending, this will reduce public consumption, in which case it should be asked which element is larger:

- The increase in private consumption and investment, or

- The amount by which public consumption will be reduced.

- Inflationary gap (inflation = price increases)

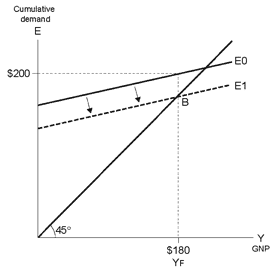

An inflationary gap means that demand is greater than the country can supply (i.e., the demand is “too high”). One example would be if demand totals $200, while the maximum GDP can supply goods and services totaling only $180.

As a concrete example, consider a country that produces only bread. Assume that aggregate demand totals $200 (Diagram 11.12), which is composed solely of 200 loaves of bread priced at $1 each. On the other hand, the country can produce only 180 loaves of bread, with a value of $180 ($1 per loaf).

Inflationary gap

Inflationary gap

In this situation there is a shortage of bread, which producers will exploit. They will raise the price of bread further and further until demand falls to 180 loaves of bread, and ultimately equals the maximum GDP. At that point, there would no longer be a shortage of bread.

Dr. Keynes’s solution for preventing inflation (price increases):

In order to prevent a rise in prices, Keynes proposes reducing aggregate demand from E0 to E1 so that E1 intersects the diagonal at B where equilibrium is ideal (what do you think about this brilliant idea?).

Aggregate demand can be lowered by reducing any of the aggregate demand components: Private consumption, public consumption, and investment.

Measures that cause lower demand

The measures proposed in opposition to Dr. Keynes in cases when a deflationary gap exists are as follows:

- Reducing public consumptio

- Increasing the interest rate.When the interest rate rises, then saving becomes more attractive. Private individuals prefer to reduce the amount of money that they “waste”, so they put the money into savings, because they receive more interest on it. The sameistrue of enterprises: they prefer buying fewer investment goods, and receiving a higher interest rate on their money in a savings accounts.

- Levying taxes

Levying taxes has the following effects:

- It reduces private consumption because people retain less money.

- Reducing investment – enterprises are left with less money in the bank for investments.