This chapter teaches us three great truths:

- A machine that is only capable of producing 100 chocolate bars each day cannot produce 101 chocolate bars.

- If the government is kind to its citizens, and deposits $1 million into the bank accounts of each one of them, they will not be richer. They will not be able to buy more products. They will only pay more for each product.

- Every Dollar in the country that passes from one hand to another in order to pay for the purchase of a new product has an effect equivalent to $1. Or, in more formal language, any purchase of $1 adds $1 to the gross domestic product (GDP),assuming that there are no imported components used in the manufacture of the product.

Example

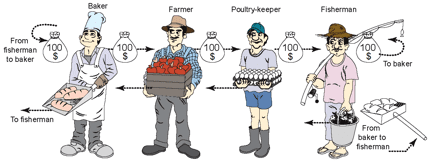

These points will be highlighted through the example of country A, in which four businesses operate, and where the money supply is $100 in cash.

At the beginning, all of this $100 is in the hands of the baker.

- The baker decides to buy vegetables from the [vegetable] farmer for $100. Production (growing) of vegetables adds $100 to the gross domestic product (GDP) .

- The [vegetable] farmer decides to buy eggs from the poultry grower [chicken farmer] for $100.

The production of eggs adds $100 to the GDP.

- The poultry grower [chicken farmer] decides to buy fish from the fisherman for $100.

The production of fish adds $100 to the GDP.

- The fisherman decides to buy bread from the baker for $100.

The Production of bread adds an additional $100 to the GDP.

Total gross domestic product (GDP): $400.

The transactions conducted by the four business owners are presented in Figure 9.1

Figure 9.1

The transactions conducted by the four business owners in country A

The business owners conducted these transactions in January, and they repeat them every month. During the course of the year, GDP reaches $4,800 ($400 X 12 months), as shown in Table 9.2.

GDP in Country A during an entire year

|

Month |

Baker |

Farmer |

Poultry Grower |

Fisherman |

Total |

|

January |

$100 |

$100 |

$100 |

$100 |

$400 |

|

February |

$100 |

$100 |

$100 |

$100 |

$400 |

|

March |

$100 |

$100 |

$100 |

$100 |

$400 |

|

April |

$100 |

$100 |

$100 |

$100 |

$400 |

|

May |

$100 |

$100 |

$100 |

$100 |

$400 |

|

June |

$100 |

$100 |

$100 |

$100 |

$400 |

|

July |

$100 |

$100 |

$100 |

$100 |

$400 |

|

August |

$100 |

$100 |

$100 |

$100 |

$400 |

|

September |

$100 |

$100 |

$100 |

$100 |

$400 |

|

October |

$100 |

$100 |

$100 |

$100 |

$400 |

|

November |

$100 |

$100 |

$100 |

$100 |

$400 |

|

December |

$100 |

$100 |

$100 |

$100 |

$400 |

|

January-December |

$1,200 |

$1,200 |

$1,200 |

$1,200 |

$4,800 |

We assume that all of the products are produced inside the country, and that there aren’t any imports

What is interesting in the above description is that all of the activity in the country has been generated from only $100.

In order for $100 to create $4,800 in terms of GDP, this same $100 must change hands 48 times during the year..

Instead of the term “change hands”, economists use the term “velocity of the circulation of money.”

According to the above example, the velocity of the circulation of money is 48 times per year, or, in other words, every Dollar changes hands an average of 48 times per year.

Use of the equation

The three truths discussed above are represented by a four-letter equation (two on each side). The letters in the equation link money to its transformation into products.

The equation is MV = PT

Explanation:

|

Money Supply |

|

Velocity of the Circulation of Money |

|

Price Index |

|

GDP |

|

↓ |

|

↓ |

|

↓ |

|

↓ |

|

M |

X |

V |

= |

P |

X |

T |

Explanation of P

P symbolizes the price index, although it is not a monetary sum of products. For the sake of simplicity, let’s assume that at the beginning, P = 1 (the price index equals 1).

If the average of all prices in a country doubles, then P = 2, and if the prices rise five-fold, then P = 5.

According to the above equation, MV represents the demand for goods, while PT represents the supply of goods.

A balanced economy is denoted as MV = PT, i.e. a situation during which the demand for goods remains equal to the supply of goods. Upsetting the equality between MV and PT results in economic processes that are intended to restore the economy to a balance through either a change in prices or the GDP.

Applying the Equation in an Example

Substituting the figures from the above example of country A into the equation, we get:

|

Money Supply |

|

Velocity of the Circulation of Money |

|

Price Index |

|

GDP |

|

M |

X |

V |

= |

P |

X |

T |

|

↓ |

|

↓ |

|

↓ |

|

↓ |

|

$100 |

X |

48 |

= |

1 |

X |

$4,800 |

Before beginning to present the complexities of the equation, assume that all four businesses in the country work every day from morning until night, or, in other words, these companies operate at full capacity.

When there is full employment in the economy, a line is placed over Ť, and the equation becomes MV = PŤ.

What can be learned from this equation?

Each letter in the equation is called a variable for the simple reason that it is dependent upon other factors. The money supply can increase or decrease, as can velocity of the circulation of money, as well as prices and GDP.

We will now follow a number of scenarios where a change occurs in one variable, and then we will examine how these changes affect the other variables. The assumption is that both sides of the equation must be equal.

Scenario 1

An increase in the money supply

↑

MV = PŤ

Possible effects:

General

- An increase in prices (P).

- A decrease in the velocity of the circulation of money (V).

- A combination of these two effects.

Comments:

- Ť cannot increase, since the economy has reached a state of full employment. Were the economy not in a state of full employment, T could certainly increase and would be likely to do so.

- Were the money supply (M) to double, and were the entire effect to be demonstrated in terms of prices (P), then these prices would also double.

For example, if we assume that initially P is equal to 1, then following the doubling of the money supply P would be equal to 2.

Scenario 2

A decrease in the money supply

MV = PŤ

↓

Possible effects:

- A decrease in GDP (Ť).

- A fall in prices (P).

- An increase in the velocity of the circulation of money (V).

- A combination of these effects.

Scenario 3

An increase in the velocity of the circulation of money

↑

MV = PŤ

Possible effects:

- A decrease in the money supply (M) (Only the Bank of America can decrease the money supply)

- A rise in prices (P)

- A combination of these effects.

Note: If Ť had not reached full employment, then a rise in Ť would be the most likely possibility.

Scenario 4

A decrease in the velocity of the circulation of money

MV = PŤ

↓

Possible effects:

- A decrease in GDP (Ť).

- A fall in prices (P).

- An increase in the money supply (M).

- A combination of these effects.

Scenario 5

A rise in prices, following a rise in the prices of raw materials

↑

MV = PŤ

Possible effects:

- A decrease in GDP (Ť).

- An increase in the velocity of the circulation of money (V).

- Combination of these effects.