Consider the following special types of Treasuries :

-

Index-linked bonds.

-

Zero coupon bonds.

Treasury Inflation Protected Securities (TIPS)

Starting in 1997, the U.S Treasury began issuing index-linked bonds. These bonds are designed to protect against erosion of the value of money caused by inflation during the investment period. The only index-linked bonds currently issued are T-notes, but index-linked T-bonds that were issued in the past are also still available in the secondary market.

Linkage to the CPI applies both to the principal and interest paid on the adjusted principal, as described in the following example: An investor buys an index-linked T-note issued for a period of 10 years at 5% nominal interest. The face value of the T-note is $1,000.

During the first six months after the bond is purchased, the U.S price index rises by 3%. The face value of the bond is therefore adjusted upwards, from $1,000 to $1,030.

The first interest payment is calculated at a specified 5% rate of interest on the $1,030 inflation-adjusted value. This process continues until the bond matures. On the maturity date, the face value of the bond is returned to the investor, plus allowances for inflation.

Since the element of inflation risk has been eliminated from index-linked bonds, the yield on them is lower than on the corresponding unlinked bonds. when inflation is expected. Yields on TIPS are higher than other Treasuries when deflation is expected.

The Adjusted Value of Index-Linked Bonds

The adjusted value of index-linked bonds on any date subsequent to their purchase is a function of two elements, i.e., the nominal interest rate and the amount of linkage to the index that has been added to the principal.

The Nominal Amount

The nominal amount includes the face value of the bond ($1,000) plus the inflation adjustments accumulated through any subsequent date.

Addition to the Nominal Amount

The inflation between Date A (i.e., the date on which the bonds are issued) and Date B is added to the stated principal. For example, if inflation between Date A and Date B was 20%, and the inflation adjustment to the original $1,000 principal was $30 on Date A, then the new value of the principal, will be – $1,030X + (1+20%) or $1,236. This value is called the adjusted value of the bond.

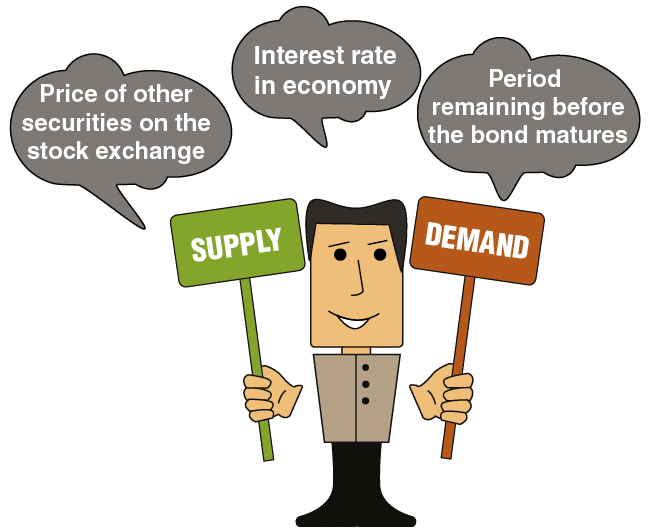

The trading price of the linked bonds is usually not exactly equivalent to their adjusted value.

The trading price is ultimately affected by supply and demand.

Many factors influence supply and demand, including:

-

Market interest rates and expectations regarding the future interest rates.

-

The periods remaining before the bond matures (i.e, whether it is one day, two years, etc.).

-

The prices of other securities traded in the markets.

-

Expectations for inflation before the maturity of the bond.

-

Many other factors.

The Adjusted Value of Index-Linked Bonds (Without Interest)

The adjusted value of a bond on Date B reflects the amount of money that the investor would have received had the bond matured on Date B.

This amount includes $1,000 (i.e, the face value of the bond), plus the increase in prices (inflation) between the issue date and Date B.

For example, if prices rose by 20%, then the adjusted value of the bond would equal $1,200. Since the index is calculated once per month and published only on the 15th of the following month (i.e., the index for May is published on June 15), ostensibly the adjustment can be calculated only once per month on the date when the index is published. Nevertheless, during a period of high inflation, investors estimate the monthly rate of inflation, and use this figure to calculate the daily inflation. They use this rate to update their records to reflect the adjusted value (and most of them use software for this purpose).

For example, if a person believes that monthly inflation is likely to reach 4%, they will add 0.13% every day (i.e., 4% divided by 30 days) to the adjusted value.

For more information about calculating the adjusted value of index-linked bonds, you can visit Chapter 8 – “Additional Information” in our course page.

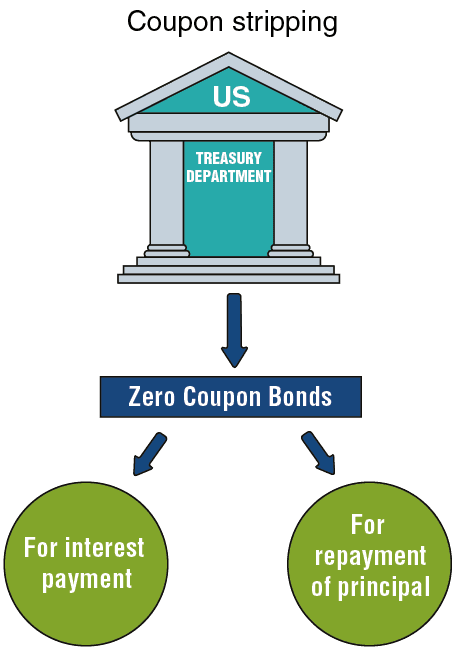

Government Zero Coupon Bonds – Treasury STRIPS

STRIPS are Treasuries that do not pay coupons;, i. e., they pay “zero” interest. For this reason, bonds that do not pay coupons are called “zero coupon” bonds or “zeros.” Brokers can create STRIPs by separating and reselling rights to a bond’s coupon and principal repayments individually.

The STRIPS bear no interest, and are sold at a discount on their price at maturity. The profit of the bondholder equals the difference between the purchase price and the repayment on the maturity date. The process of disaggregating an ordinary bond into STRIPS is called coupon stripping.

The following is an example of disaggregating a government bond into a collection of new STRIPs:

The bond being disaggregated has 10 years remaining until maturity. 20 interest payments will be paid for this bond (i.e., one interest payment every six months for 10 years until maturity). The principal will be paid in one sum in 10 years.

This bond can be disaggregated into a collection of new STRIPS as follows:

-

One bond for payment of the principal of the original bond.

-

20 more bonds: One for each interest payment on the original bond.

These 21 new bonds are all zero coupon bonds.