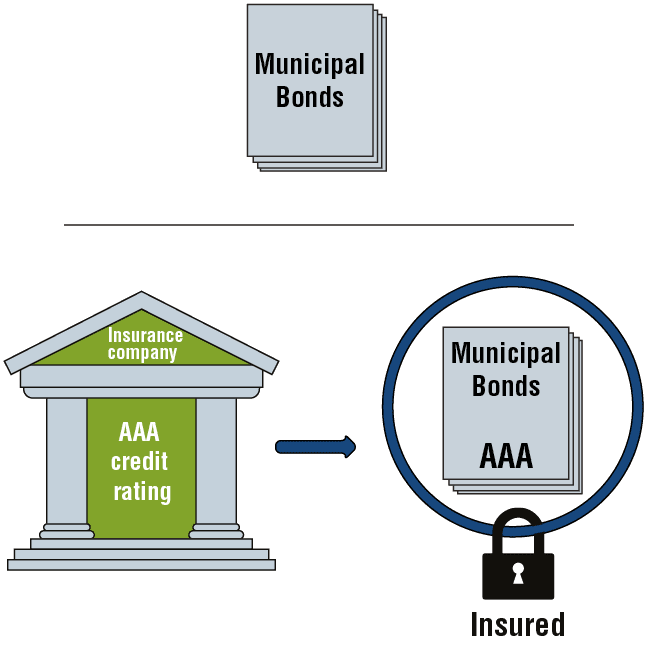

In the US, there are insurance companies that specialize in insuring municipal bonds. In cases of insolvency, the insurance company assumes the issuer’s obligations.

The issuer acquires bond insurance on the issue date and the investors are not involved in this process. Bond insurance exists only in the municipal market due to its low risk. Government bonds are not insured because no insurance company’s commitment is worth more than that of the US government.

The bond insurance industry began operating in 1971. Today, approximately 50% of municipal bonds are insured. When an insurance company insures a bond series, that series is rated according to the financial soundness of the insurer. This means that if an insurance company with an AAA credit rating insures any bond series, the series will receive an AAA rating.

-

The major bond insurance companies, each of which has an AAA credit rating, are:

-

American Municipal Bond Assurance Corporation (AMBAC).

-

Financial Guaranty Insurance Corporation (FGIC).

-

Municipal Bond Insurance Corporation (MBIA).

-

Financial Security Assurance (FSA).