Municipal Bonds

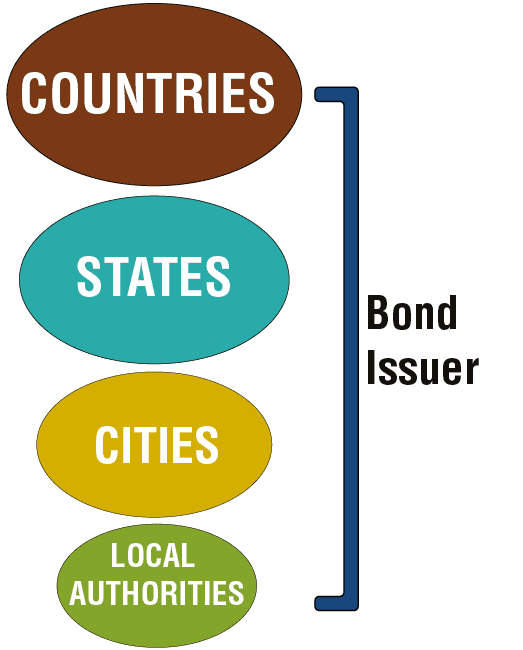

Municipal bonds are issued by:

- States

- Counties

- Cities

- Local authorities.

Municipal bonds are referred to as Munis.

Municipal bonds are usually issued in order to raise money to finance public projects, such as paving roads, construction of bridges, erection of sports stadiums, etc.

Two Types of Municipal Bonds

In terms of the quality of the guarantee, there are two types of municipal bonds:

-

General Obligation Bonds

- Revenue Bonds

General Obligation Bonds

These bonds are secured by the issuer’s entire cash flow. In the case of a city or local authority, these flows are derived mostly from tax collections, real estate taxes, other property taxes, etc.

Revenue Bonds

These bonds are secured by revenue flow from some specific project financed by the bond.

For example, in regard to bonds designated for construction of a toll road, the payments of interest and principal are secured by the expected revenues from tolls.

Municipal bonds are usually issued with a face value of $5,000 under the virtual (book-entry) registration method.

Most municipal bonds are granted a very high rating, and are considered extremely safe for investors.

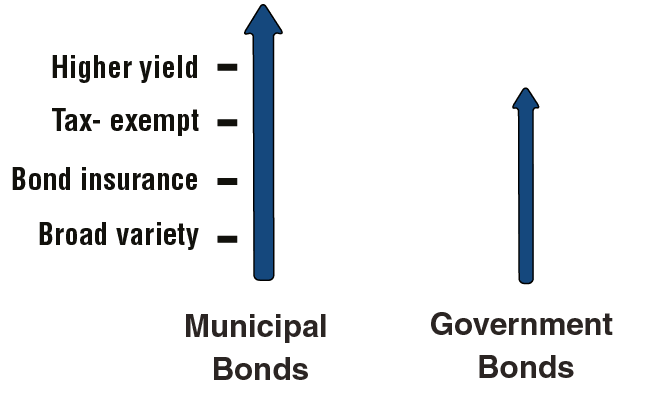

Investment Characteristics of Municipal Bonds

- Higher yield than on government bonds: Municipal bonds usually generate a higher yield than government bonds.

Tax-exempt: Interest income from municipal bonds is exempt from federal taxes in the US. Investors residing in the state in which the bonds were issued are also exempt from state and local taxes on any interest income from their bonds.

Bond insurance: In many cases, municipal bonds are also insured by bond insurance companies, thereby providing another level of protection for investors. This subject is explained in detail in the following slide.

Broad Variety: There is a broad range of municipal bonds, most of which are rated between AA and AAA.