Accounting documentation and registration constitute a basis for the preparation of the financial statements, which will be discussed below.

The principal activity accompanying the preparation of the financial statements focuses on the allocation (sorting into groups) of individual pieces of information with similar characteristics (a primary group). Primary groups with common features will later be combined into larger groups, i.e., secondary groups. If justified, secondary groups resembling each other can be combined into tertiary and fourth level groups.

The individual data are actually the balances in the bookkeeping ledger accounts.

From now on, the word “concentration” will be used to describe the process of “grouping”.

A. Concentration of Individual Data in Primary Groups

Examples:

- Concentration of “Accounts Receivable” – A ledger account is opened for each customer. The balances in all of these customers’ ledger accounts are concentrated in a new ledger account, called Accounts Receivable. A single row is registered in this ledger account, containing the total balance for all customers, as of the date on which the financial statements were prepared.

-

Concentration of “Accounts Payable” – A ledger account is opened for each supplier. The balances of all these suppliers’ ledger accounts are concentrated in a new ledger account, called “Accounts Payable”.

-

Concentration of “Raw Material Purchases” – The total balance of purchases of all raw material purchases is concentrated in a new ledger account, called Raw Material Purchases, or more succinctly, “Raw Materials”. In a furniture factory, for example, the balances of the following ledger accounts will be transferred to the Raw Materials Ledger Account: Wood Purchases, Glue Purchases, Nails Purchases, etc.

-

Concentration of Miscellaneous Manufacturing Expenditure – The balances of all Miscellaneous Expenditures, such as Electricity Expenditures, Water Expenditures, Auto Repairs, Cleaning Expenditures, Machinery Leasing Expenditures, etc. are concentrated in this ledger account.

- Concentration of “Sales” – The balances of sales from the sales ledger accounts for each of the company products are concentrated in a new ledger account, called Sales. For example, if the company sells three types of products – chairs, tables, and closets, each of which has a separate ledger account – the balances appearing in each of these three ledger accounts will be transferred to the Sales Ledger Account.

B. Concentration into “Secondary Groups”

Four groups of primary ledger accounts are concentrated in the Cost of Sales Ledger Account:

-

Raw Materials (see the above list in Example 3 for primary concentration groups).

-

Salaries (of production employees).

-

Depreciation (of machinery, equipment, and buildings).

-

Miscellaneous Manufacturing Expenditures (see the above list in Example 4 for primary concentration groups).

The balance of each primary group is transferred to the Cost of Sales Ledger Account.

Summation of the Concentration Transaction

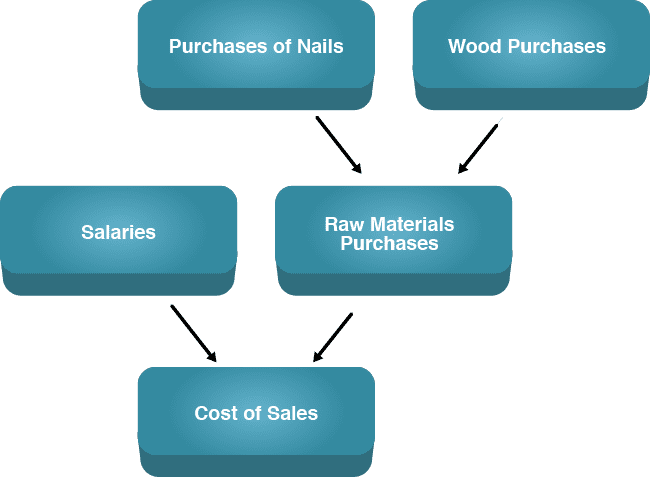

The concentration transaction includes many small items, and gradually concentrates them into larger groups. For example, if the company buys wood, this transaction is first registered in the Wood Purchases Ledger Account. In the second stage, everything accumulated in the Wood Purchases Ledger Account (together with what has accumulated in similar ledger accounts, such as the Nails Purchases Ledger Account) is transferred to the Raw Materials Purchases primary concentration group.

In the third stage, everything that has accumulated in the Raw Materials Purchases Ledger Account is transferred (together with whatever has accumulated in other corresponding ledger accounts, such as the Salaries Ledger Account) to the Cost of Sales secondary concentration group.

It is important to note that although the concentration transaction appears long and boring, today it is done automatically by computer (through suitable bookkeeping software), and requires no special effort by the bookkeeper.