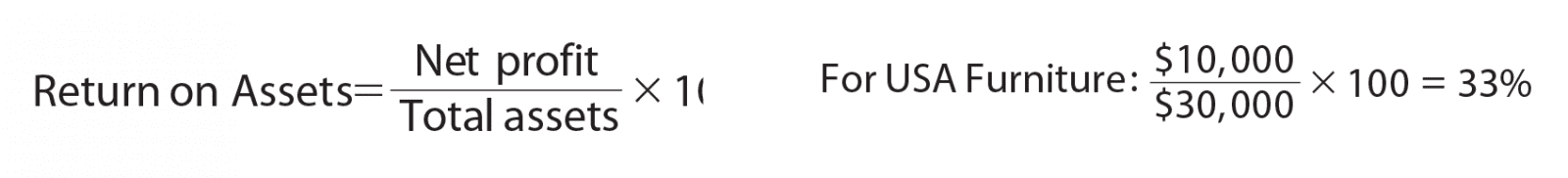

Return on Assets

Purpose of the ratio: The return on assets (ROA) calculates the profit (in percentages) generated by the company on its total assets. In other words, the ROA shows the return that the assets of the company generate over a period.

ROA is calculated from two elements:

The total value of company assets at the beginning of the period, presented on the prior balance sheet.The increase in equity, measured by either the change in equity on the balance sheet or net income on the income statement.

ROA is calculated as follows:

or

Interpretation of the results: The ROA ratio reflects a company’s efficiency and represents the amount of profit generated from all of its assets.

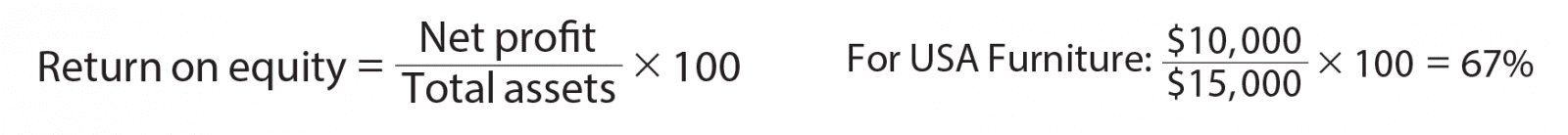

Return on Equity

Purpose of the ratio: The return on equity (ROE) calculates the profit (in percentages) generated by the company on the shareholders’ investment.

ROE is calculated from two elements:

-

Equity at the beginning of the period presented on the prior balance sheet.

-

The increase in equity, either measured by the change in equity on the balance sheet or net income on the income statement.

ROE is calculated as follows:

or

Interpretation of the results: ROE reflects an increase in the owner’s investment in the company over a period. ROE was 67% in the case of USA Furniture, for example.

This is a very high result. In practice, significantly lower results can be expected. Shareholders are usually dissatisfied with a ROE of less than 10%.

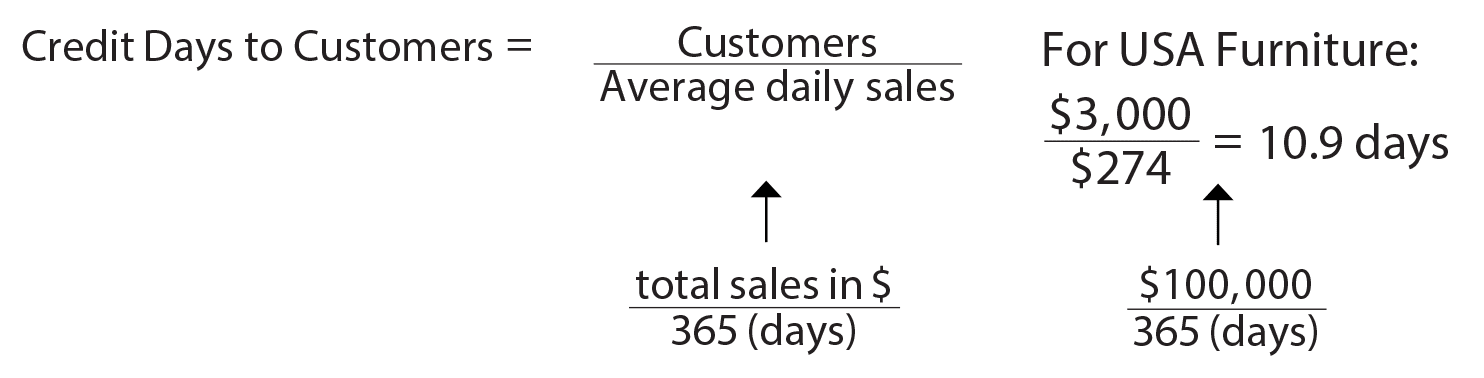

Days Receivable (DSO)

Purpose of the ratio: The “Days Receivable” or “Days Sales Outstanding” ratio calculates the average length of time that the company’s customers take to pay for goods. In other words, this ratio shows the length of time during which a company provides credit on each sale.

Days Receivable is calculated as follows:

Note that “accounts receivable” is also sometimes called “customers” or “debtors” on the balance sheet.

The result for USA Furniture is 11 days (rounded off). This means that a customer takes 11 days to pay the company.

Interpretation of the results: The interpretation of the results indicates that USA Furniture grants an average of 11 days of credit on every sale of furniture to its customers. This is based on the unrealistic assumption (which will be discussed below) that USA Furniture sells $274 of furniture, its average daily sales in 2007, each day. (See ratio data).

Significance of the calculation of the ratio: The result (11 days) shows that USA Furniture grants 11 credit days on each sale of furniture. Therefore, 11 sales days are accumulated from December 20, 2007, until December 31, 2007, (the balance sheet date) for which the company has not yet collected any money. Sales total $3,000 during these 11 days ($274 per day, multiplied by 11 days).

An explanation from another perspective: In order to reach the cumulative sum of $3,000 in its accounts receivable (also called “customers”) item, USA Furniture must grant credit for sales worth 11 days of sales (keep in mind that it is assumed that $274 of furniture is sold each day). How does USA Furniture arrive at a situation in which it grants credit for 11 sales days? It grants 11 credit days for every sale. In this situation, the company does not yet collect money for sales made during the last 11 days of the year (from December 20, 2007, until December 31, 2007).

On January 1, 2008 (the new year), the company will collect the proceeds for sales that it made on December 20, 2007, while granting additional credit for sales made on the first day of 2008. If average daily sales remain at the same level in 2008 as in the preceding year, then the credit granted by the company for its sales on January 1, 2008, will be $274, the same figure collected for sales on December 20, 2007.

The accounts receivable item will therefore remain constant at $3,000 for the entire year.

Remember: If, for example, the company grants four credit days on each sale, then a sum equal to four days of sales will accumulate in the accounts receivable item. If the company grants 100 credit days on each sale, then a sum equal to 100 days of sales will accumulate in the accounts receivable account on the balance sheet. These calculations assume that the company’s sales remain constant each day during the year.

The assumption concerning constant daily sales: The assumption that the daily sales of USA Furniture (or any other company) will remain constant at the level of its average daily sales is unrealistic. In practice, it is obvious that the volume of sales varies from day to day. Nevertheless, if the year is divided into periods consisting of the number of days obtained by calculating the ratio (11 days for USA Furniture) and the fluctuations of total sales during the periods is not too extreme, then the results of the ratio will reflect the average number of credit days that the company grants its customers. The reason for adding the word average to this sentence will be explained later.

Situations in which the results of the ratio do not properly reflect the actual situation: If it turns out, for example, that USA Furniture’s sales are crowded into two seasons every year – Halloween (10% of sales) and December (90% of sales) – then the result obtained of 11 days can be misleading. In this situation, USA Furniture sold furniture for $90,000 in December, making its average daily sales for this month $3,000, instead of $274.

At a daily sales volume of $3,000, providing a mere two days of credit would put the accounts receivable item on the balance sheet date at $6,000, which is more than the $3,000 accounts receivable item listed in the balance sheet. Furthermore, at a daily sales volume of $3,000, granting 11 credit days would cause the accounts receivable item to soar to $33,000 ($3,000 x 11 days) on the balance sheet date, far in excess of the $3,000 listed for the accounts receivable item in the balance sheet.

In this situation, the calculation of the ratio should be based on the following data:

Average credit period: The word “average” should be stressed, for the reason that the company does not grant the same credit period to all of its customers. USA Furniture may grant large customers 60 credit days, while small customers receive only five credit days or no credit whatsoever.

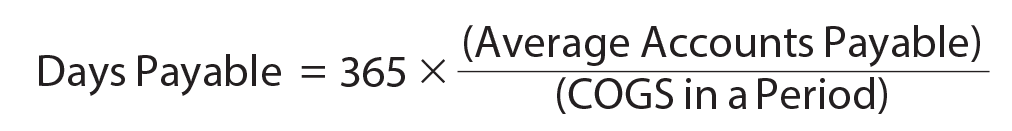

Days Payable (DPO)

Purpose of the ratio: Days payable, also called Days Payable Outstanding (DPO), is a measure of the average time it takes for the company to pay its suppliers. In other words, this is the average length of time during which the company receives credit from its suppliers.

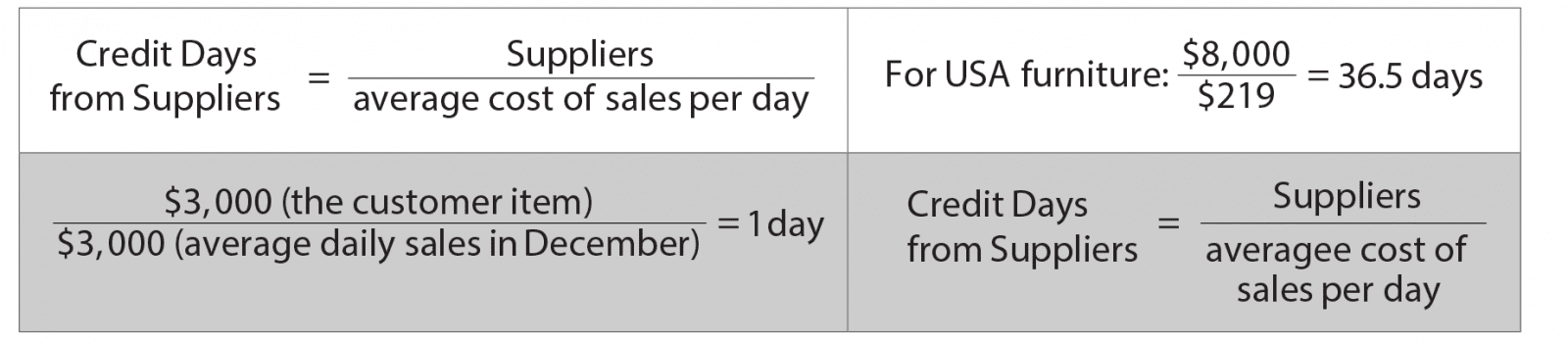

Days payable is calculated as follows:

Interpretation of the result: The calculation is based on the (unrealistic) assumption that USA Furniture’s daily cost of good sold remains constant at $219 (total cost of sales in 2007, divided by 365 days). An interpretation of the results indicates that USA Furniture receives an average of 37 credit days for each purchase that it makes.

In other words, the result of 37 days indicates that USA Furniture receives an average of 37 credit days on each purchase, and accumulates 37 credit days during which it pays nothing for its purchases. The company’s purchases during these 37 days therefore total $8,000 ($219 cost of sales per day, multiplied by 37 days). In the business world, 37 credit days is considered very low. Companies usually grant their customers 30 to 120 credit days. Any ratio result fewer than 120 days is therefore considered reasonable. For most companies, if the ratio is significantly higher than 120 days (for example, 200 days or more), the result should serve as a warning about the company’s ability to pay its suppliers.

The meaning of the average: In practice, the company does not receive the same credit period from each supplier. Certain suppliers may grant the company 100 credit days, while other suppliers grant it only 1.

The result of the days payable ratio therefore reflects the average number of credit days that the company receives from its supplier.

Interpretation of the ratio

The result of the “DPO” ratio for USA Furniture is 37 days. In the business world, companies usually receive 30-120 credit days from suppliers. Any result of the ratio that is not greater than 120 days is therefore considered reasonable.

A Comparison between “Days Payable” and “Days Recievable”

Usually, the stronger a company is, the more it manages:

-

To increase the number of days payable that it receives from suppliers.

-

To decrease the number of days recievable that it grants to its customers.

For this reason, the more a company’s days payable from suppliers ratio exceeds the result of its days recievable for customers, the sounder the company is.

On the other hand, when the result of a company’s days recievable is significantly higher than its days payable, it could indicate that the company has liquidity problems.

Days Sales of Inventory (DSI)

Purpose of the ratio:

This ratio calculates the number of workdays necessary to accumulate a company’s existing inventory of finished products, assuming that the company’s average daily production remains equal to the value of the daily cost of sales.

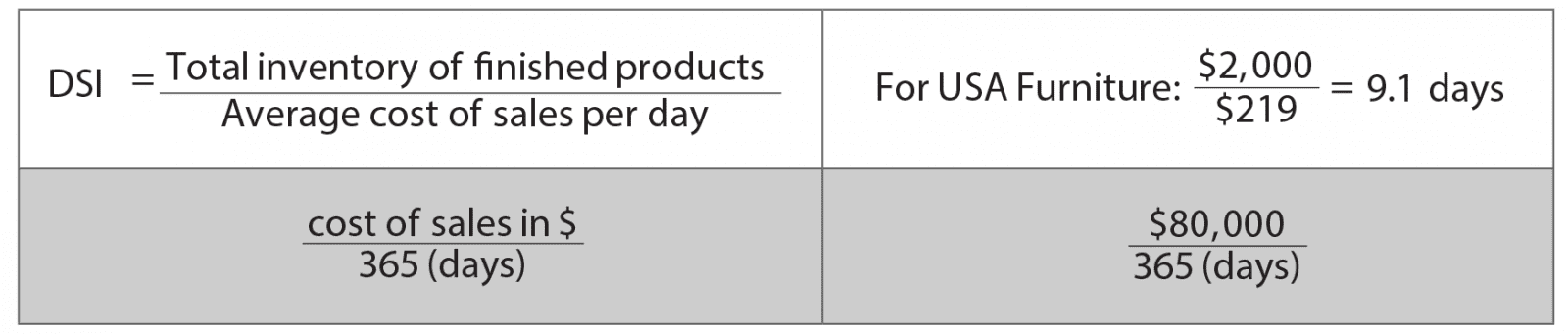

Days Sales of Inventory is calculated as follows:

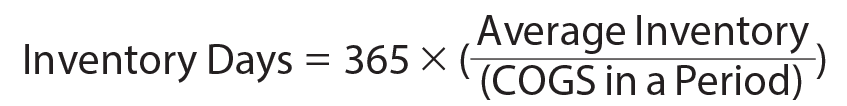

Inventory Days = 365 x (Average Inventory) / (COGS in a Period)

This ratio calculates the number of workdays necessary to accumulate a company’s existing inventory of finished products, assuming that the company’s average daily production remains equal to the value of the daily cost of sales.

Significance of the result

USA Furniture’s daily cost of sales is $219. The number of USA Furniture’s inventory days is nine (rounded off). This figure means that USA Furniture’s inventory of finished products is equal in value to the value of its output over nine days.

Interpretation of the result

A company that sells its full output every day has no inventory whatsoever of finished products. On the other hand, a company that sells none of its output during the entire year accumulates the output of 300 workdays (365 days, excluding weekends, holidays and personal days off) in its inventory.

Remember: Daily output is equal to the average daily cost of sales. In general, it can be stated that the lower this ratio, the more efficient the company. When the inventory days ratio is greater than 150 days, it should serve as a warning that the company is working to accumulate inventory and that there is little demand for the goods that it produces.