Every ledger account has four columns. The two middle columns, (2) and (3), are the heart of the ledger account.

|

Particulars of the Transaction (1) |

Monetary Sum |

||

|

Debit (2) |

Credit (3) |

Balance (4) |

|

|

|

|

|

|

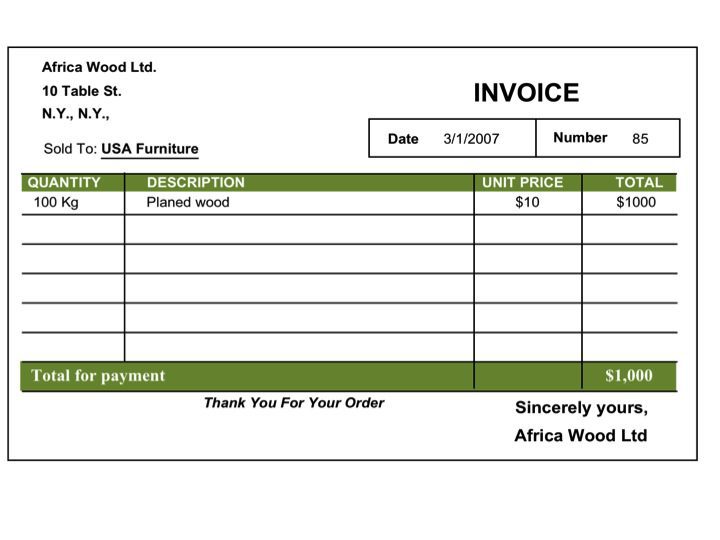

Explanation of the ColumnsThe USA Furniture company will register this transaction in two ledger accounts:

- “Wood Purchases” – the registration represents receiving.

- “Africa Wood” – the registration represents giving.

The registration data is taken from the invoice.

Sub-columns for each of the ledger accounts are as follows:

Wood Purchases Ledger Account

|

Particulars (Column 1) |

|||

|

Date |

Particulars of Transaction |

Reference |

Contra Account |

|

March 1, 2007 |

100 kg of planed wood |

85 |

Africa Wood |

Africa Wood Ledger Account

|

Particulars (Column 1) |

|||

|

Date |

Particulars of Transaction |

Reference |

Contra Account |

|

March 1, 2007 |

100 kg of planed wood |

85 |

Wood Purchases |

An explanation of registration of particulars

-

Date – the date of registration in the ledger account.

- Reference – the reference is usually the invoice number.

- Contra ledger account – the other ledger account in which the same transaction is registered. Accountants use the term contra account instead of contra ledger account, and the shorter term will be used here from now on.

- Particulars of the transaction – a summary description of the elements of the transaction. In this example, the particulars of the transaction are described as “100 kg of planed wood”. The word “purchase” does not appear in the particulars of the transaction, because it is obvious that every transaction registered in the wood purchase ledger account and in the Africa Wood ledger account represents a purchase, unless stated otherwise.

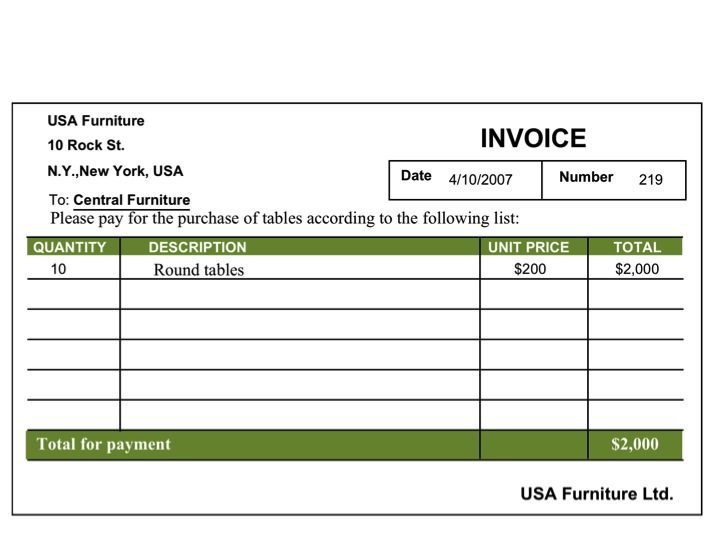

Example 2

The USA Furniture company sold 10 round tables to Central Furniture (a customer) for $2,000, and sent the following invoice:

The USA Furniture company will register this transaction in two ledger accounts:

-

Sales of tables – registration represents revenue from the sale of tables.Central Furniture – registration represents receipt (of tables).

- Registration of the Particulars in the Ledger Accounts:

Sales of Tables ledger account

|

Particulars |

|||

|

Date |

Particulars of Transaction |

Reference |

Contra Account |

|

April 10, 2007 |

10 round tables |

219 |

Central Tables |

Central Furniture ledger account (customer)

|

Particulars |

|||

|

Date |

Particulars of Transaction |

Reference |

Contra Account |

|

April 10, 2007 |

10 round tables |

219 |

Sales of Tables |

Columns 2 and 3 – Debit and Credit

In one of these columns, and in only one of them, the sum listed in the invoice will be registered.

But in which?

Knowing the answer is half the work of earning a diploma in bookkeeping.

The answer is very simple: When a transaction representing receipt is registered in a ledger account, the sum is listed in the column entitled “Debit” (Column No. 2). In bookkeeping language, the ledger account has been “debited”. When a transaction representing giving is registered in the ledger account, the sum is listed in the column entitled “Credit” (Column No. 3). In bookkeeping language, the account has been “credited”.

In example No. 1: The Wood Purchases ledger account will be debited $1,000 (the sum will be listed in the “debit” column), because the company received wood. The Africa Wood ledger account will be credited for the same sum (the sum will be listed in the “credit” column), because Africa Wood provided wood.

In example No. 2: The Sales of Tables ledger account will be credited with $2,000, because the company provided tables. The Central Furniture ledger account will be debited for the same sum, because Central Furniture received tables.

|

Particulars of the Transaction (1) |

Monetary Sum |

||

|

Debit (2) |

Credit (3) |

Balance (4) |

|

|

|

|

|

|

Column 4 – Balance

The sum written in each row represents the difference between the sum in Column 2 (debit), up to and including that row, and the sum in Column 3 (credit), up to and including the same row.

When the difference is in favor of the debit column (the cumulative sum in it is greater), the sum in the balance column is accompanied by the letter D (for debt).

Registration in Ledger Accounts – A Summarizing Example

The USA Furniture company conducted three sales transactions for round tables with Central Furniture, as follows:

-

On April 10, 2007, 10 round tables were sold for $2,000.

The sale was accompanied by Invoice No. 219. - On May 10, 2007, 20 round tables were sold for $4,000.

The sale was accompanied by Invoice No. 230. - On June 10, 2007, five round tables were sold for $1,000.

The sale was accompanied by Invoice No. 238.

The following are the particulars of the rows that will be registered in the two ledger accounts accompanying the transaction: Sales of Tables and Central Furniture.

Sales of Tables Ledger Account (Sales)

|

Particulars |

Sums |

|||||

|

Date |

Particulars of Transaction |

Reference |

Contra Account |

Debit |

Credit |

Balance |

|

April 10, 2007 |

10 round tables |

219 |

Central Furniture |

|

2,000 |

2,000 |

|

May 10, 2007 |

20 round tables |

230 |

Central Furniture |

|

4,000 |

6,000 |

|

June 10, 2007 |

5 round tables |

238 |

Central Furniture |

|

1,000 |

7,000 |

Central Furniture Ledger Account (Customer)

|

Particulars |

Sums |

|||||

|

Date |

Particulars of Transaction |

Reference |

Contra Account |

Debit |

Credit |

Balance |

|

April 10, 2007 |

10 round tables |

219 |

Sales of Tables |

2,000 |

|

2,000 D |

|

May 10, 2007 |

20 round tables |

230 |

Sales of Tables |

4,000 |

|

6,000 D |

|

June 10, 2007 |

5 round tables |

238 |

Sales of Tables |

1,000 |

|

7,000 D |