The balance sheet presents a picture of the company’s situation on the final day of the reporting period (usually December 31, the last day of the year). It contains the company’s properties on one side, and its debts on the other. In accounting, those properties, that can generate cash in the future, are called “Assets”, and the debts or the ones that must be paid in the future, are called “Liabilities”.

The following example belongs to Chess Pizza Company, which operates a neighborhood pizza parlor.

The left column lists all of the company’s assets, while the right column lists all of its liabilities.

Chess Pizza’s Balance Sheet as of December 31,2013 ($)

|

Assets (Company Property) |

Liabilities |

||

|

Current Assets |

Current Liabilities |

||

|

Cash |

3,500 |

Accounts Payable |

4,000 |

|

Inventory |

4,000 |

Long-term Liabilities |

|

|

Accounts Receivable |

2,500 |

Bank loans |

6,000 |

|

Fixed Assets |

|

|

|

|

Furniture |

4,000 |

Equity (explanation below) |

20,000 |

|

Machinery and equipment |

6,000 |

|

|

|

Building |

10,000 |

|

|

|

Total Assets |

30,000 |

Total Liabilities + Equity |

30,000 |

Chess Pizza Company

Assets:

Company has assets totaling $30,000 as of year ended 2013.

Cash:

The amount of money that the company has in its treasury and/or its current account is $3,500.

Inventory:

As stated in the preceding chapter, inventory is composed of several categories:

-

Inventory of Raw Materials – materials for making pizza, such as flour, tomatoes, and cheese.

-

Inventory in Production – pizzas in the preparatory stages.

Inventory of Finished Products – pizzas ready for sale.

Chess Pizza had inventory worth $4,000 as of year ended 2013.

Accounts Receivable:

This item is abbreviated as AR. The sum is the amount of money that customers still owe to the company for purchases of pizza. Chess Pizza has regular customers who pay two months after receiving pizzas. As of the indicated date, customers owed the company a total of $2,500 for pizzas that they purchased.

Furniture:

This item includes tables, chairs, a wooden counter, etc. The total value of the company’s furniture was $4,000.

Machinery and Equipment:

This item includes ovens, pizza-cutting machines, kitchen utensils, a cash register, a computer, etc. worth a total of $6,000.

Building:

The company owns the building in which the pizza parlor is located. The building is worth $10,000.

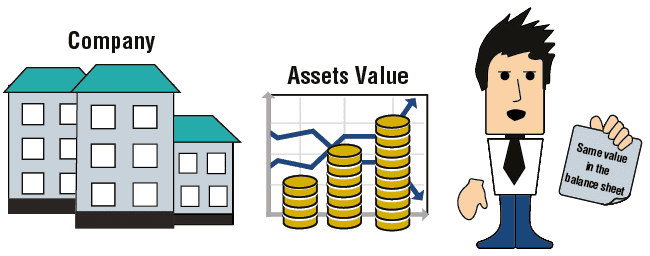

The Value of Assets

The price listed will be based on the asset’s PURCHASED PRICE.

For long-term assets, like building and equipments, the price indicated must be already deducted by depreciation expense (which the amount appears in the income statement).

The building owned by Chess Pizza is currently worth $100,000 (as estimated by an assessor), but it is listed at its purchase price of only $10,000. The value of assets should therefore be used with caution, because it does not always reflect their real value.

In many cases, the value of fixed assets differ from their market value.

For 2014 statement, the building will no longer be $10,000 because the it already depreciated with one year of use. Therefore, if the computed depreciation expense is $1,000, then the amount that will be reflected as the value of the building for year ended 2014 will be $9,000.

Liabilities:

The liabilities item lists the company’s debts as of year ended 2013.

Accounts Payable:

This section is abbreviated as AP. It lists the sums that the company still owes to its suppliers for the merchandise that it purchased. In the business world, companies do not pay immediately for the merchandise that they buy; they pay at a later date (after one or two months, or even longer).

Chess Pizza still owed its suppliers $4,000 as of year ended 2013.

Bank loans:

This item lists the outstanding balance of the loans that the company owes to banks ($6,000).

Equity:

When a company’s total assets are greater than its liabilities (which is usually the case), the difference between them is called “equity”, and is listed in the right column, under the liabilities items.

Listing the equity in the right column makes the total of the right column equal the total in the left column. That is why this statement is called a balance sheet: the totals of the two columns “balance” (i.e. are equal).

|

Assets (Company Property) |

Liabilities |

||

|

Current Assets |

Current Liabilities |

||

|

Cash |

3,500 |

Accounts Payable |

4,000 |

|

Inventory |

4,000 |

Long-term Liabilities |

|

|

Accounts Receivable |

2,500 |

Bank loans |

6,000 |

|

Fixed Assets |

|

|

|

|

Furniture |

4,000 |

Equity (see explanation below) |

20,000 |

|

Machinery and equipment |

6,000 |

|

|

|

Building |

10,000 |

|

|

|

Total Assets |

30,000 |

Total Liabilities + Equity |

30,000 |

In the previous example, the assets total $30,000, and the liabilities (to suppliers and banks) total $10,000. The equity is equal to the difference between them – $20,000.

In order to avoid confusion in this explanation, the heading of the right column was listed as “Liabilities”, but its full name should actually be “Liabilities + Equity”.

Equity Definition and Subsections

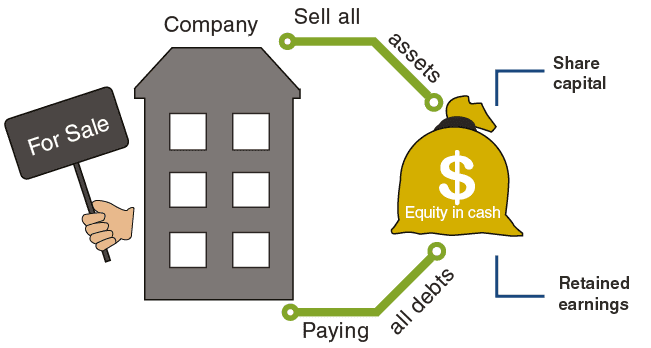

When the company already decide to liquidate or to sell all its assets at the value listed in the balance sheet to pay all of its debts to suppliers and banks, equity are the ones that will remain, assuming that the amount of assets liquidated paid off all liabilities (A – L = E). This belongs to the company owners and share holders.

If the amount of liabilities is more than the amount of assets, then equity will be negative.

It is therefore like a company debt to its shareholders that can be collected only under special circumstances, such as when a company is being liquidated. It has two subsections:

- Share capital – money invested in the company by the owners is called share capital. The term is derived from the fact that the company issues (gives out) its shares in exchange for the money.

- Retained earnings – profits accumulated by the company that the owners have not yet withdrawn. When the owners withdraw any sum for their private use, that sum is reduced from the retained earnings. The transaction in which the owners withdraw money from the company’s profits is called distribution of a dividend.