The theory of finance opens our eyes, particularly in the field of investments. For example, the theory instructs us which financial track to choose of those offered to us. Assume that you are offered $2,000 in one of the following three tracks:

1. Today. 2. One year from now. 3. Two years from now.

The theory of finance proposes that you choose the first track.

Explanation: If you receive the money now, you will be able to deposit it in a savings plan, and in a year from now, you will have more than $2,000. Of course, anyone who has finished kindergarten will also reach this conclusion.

A slightly more difficult example:

You are offered a sum of money according to one of the following three tracks:

1. $2,000- Today . 2. $2,020 one year from now. 3. $2,040 two years from now.

In order to decide which track is preferable, you must answer the question: “By following which track will I have more money two years from now”?

In order to answer this question, you must know the interest rates each of the savings plans offers. You will find out the answer in the next slide.

The banks are offering 5% interest per year. In this situation, the theory of finance proposes that you choose Track no. 1, as can be seen in the table.

Table 2.1

| Track No. 1 | Track No. 2 | Track No. 3 | |

| Today | $2,000 | ||

| 1 year from now | $2,020 | ||

| 2 years from now | $2,205 | $2,121 | $2,040 |

Two years from now:

• Track no. 1 produces $2,205 after two years of compound interest in a 5% savings plan.

• Track no. 2 produces $2,121 after one year of compound interest in a 5% savings plan.

• Track no. 3 produces $2,040 without any additional interest in a savings plan.

If you have understood this, then you have understood the logic on which the theory of finance is based.

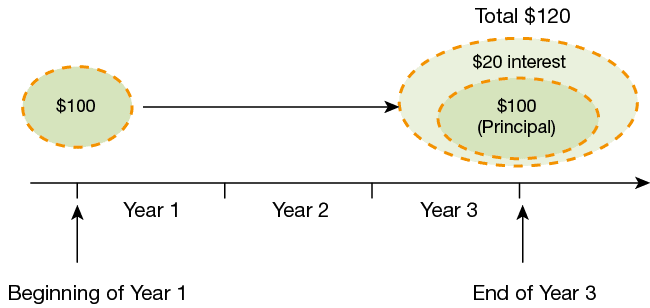

Money Grows with Time

The foundation on which the theory of finance is built is the fact that money grows with time:

-

The money you own grows to your benefit.

-

The money you owe increases to your detriment.

In the following animation, you can see that today’s $100 grows and will become $120 three years from now. If this $100 is in the form of a deposit, then three years from now you will have $120. If this $100 is a loan, then three years from now you will owe $120. The next slide will show you a tangible example.

Low Interest and High Interest

Usually, the interest that you receive for your money (from a savings plan, for example) will be less than the interest that you will have to pay back on a debt to the bank. This can be expressed by saying that savings grow more slowly than debt.